Hey folks,

It’s been a while since my last post on this stack, and I wanted to check in with a quick update!

I’ve recently relocated to the West Coast. This has been a great change, especially regarding the market session: being in the Pacific time zone means the open is a bit earlier, and the close conveniently wraps up shortly after noon. On the personal front, my family is healthy, and my spirits are high.

I plan to significantly increase my writing output here. I truly enjoy the process of getting my thoughts organized and interacting with fellow traders—it’s an outlet I value. I find this platform is a much better fit for sharing comprehensive articles, as X.com can often make detailed analysis challenging due to character limits and difficult formatting.

Finally, please note that my previous X account was compromised. If you want to follow my market commentary there, my new handle is: @geocapx

I hope this message finds you all well and that you enjoyed a fantastic Thanksgiving with loved ones. We certainly enjoyed our feast of turkey, ham, mac n cheese, scalloped potatoes, and all the desserts!

Alright, onto the market…

Market Monitor

We recently saw a shakeout and recent reclaim of the 10, 20 and 50ma. New high new low is currently green which is a good sign.

The 10ma has turned up and is in a positive degree angle, while the 20ma is flattening out.

The environment is a bit choppy at the moment, nonetheless there are stocks showing strength which is a good sign.

Individual Names

There are a lot of stocks that are showing strength. I personally like to focus on the names that are in a particular theme, or the growth names that have reported triple digit eps/sales. There are other names I’m watching as well, but these are some that may have buyable pivots soon.

MU - Micron recently bounced sharply off the 50ma, and has reclaimed the 10 / 20 moving averages. The eps/sales for this year have been amazing, and the estimates for next year continue to be strong.

The stock is surging due to bullish analyst upgrades and the accelerating demand for its High-Bandwidth Memory (HBM) chips critical for the ongoing AI data center boom.

COHR - Coherent Corp has been a growth name that I’ve been tracking for a while now. The RS on this stock has been great as the it didn’t even get to the 50ma on the markets sharp pullback. The eps/sales for this year are on the chart, and the estimates are set to accelerate next year.

The company is benefiting from strong, better-than-expected earnings driven by record demand for its optical products used in AI data centers and communication sectors.

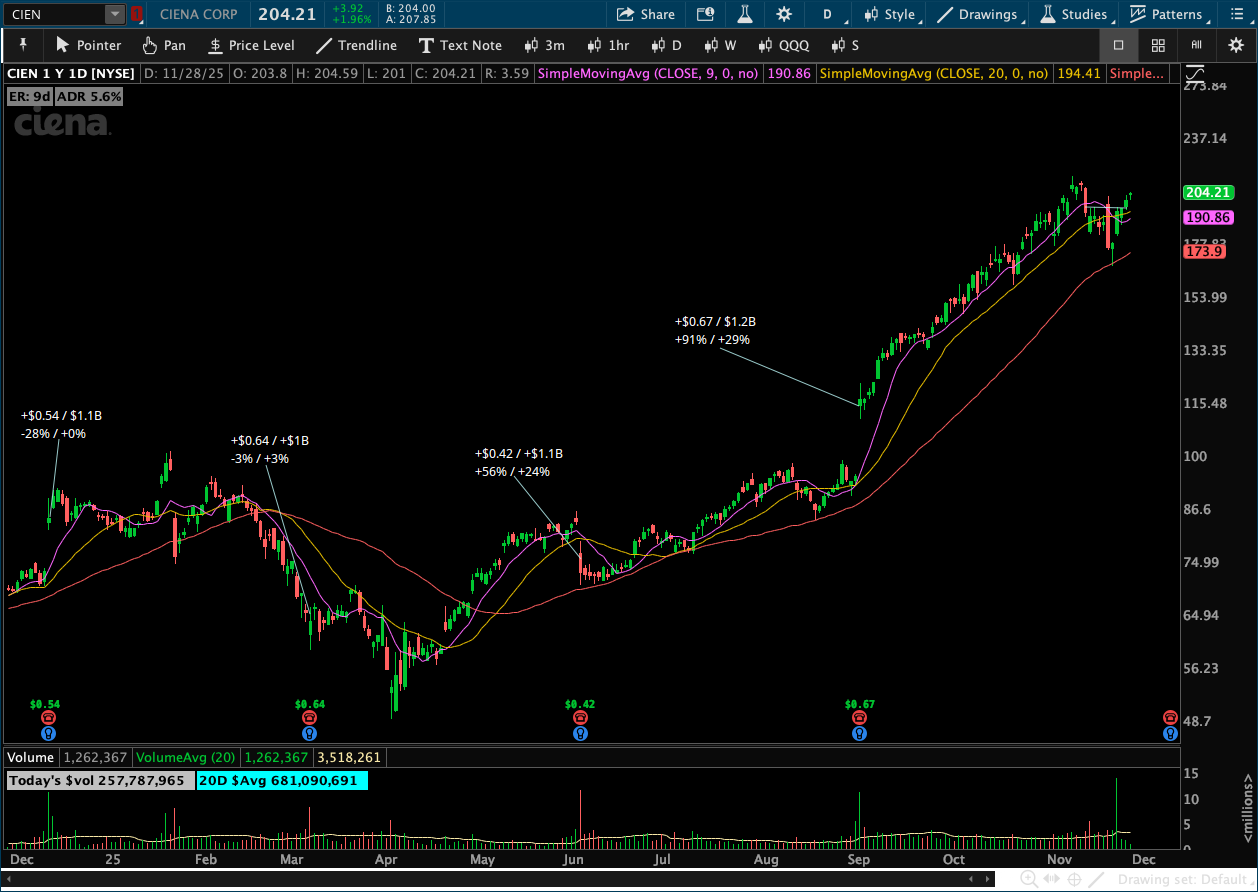

CIEN - Ciena has been trending since it’s earnings gap up in September. Recently pulled back to the 50ma, and sharply reclaimed with the help of the market.

The stock is up due to a strong revenue beat, optimistic guidance, and surging demand for its high-speed networking and optical infrastructure necessary for AI and cloud expansion.

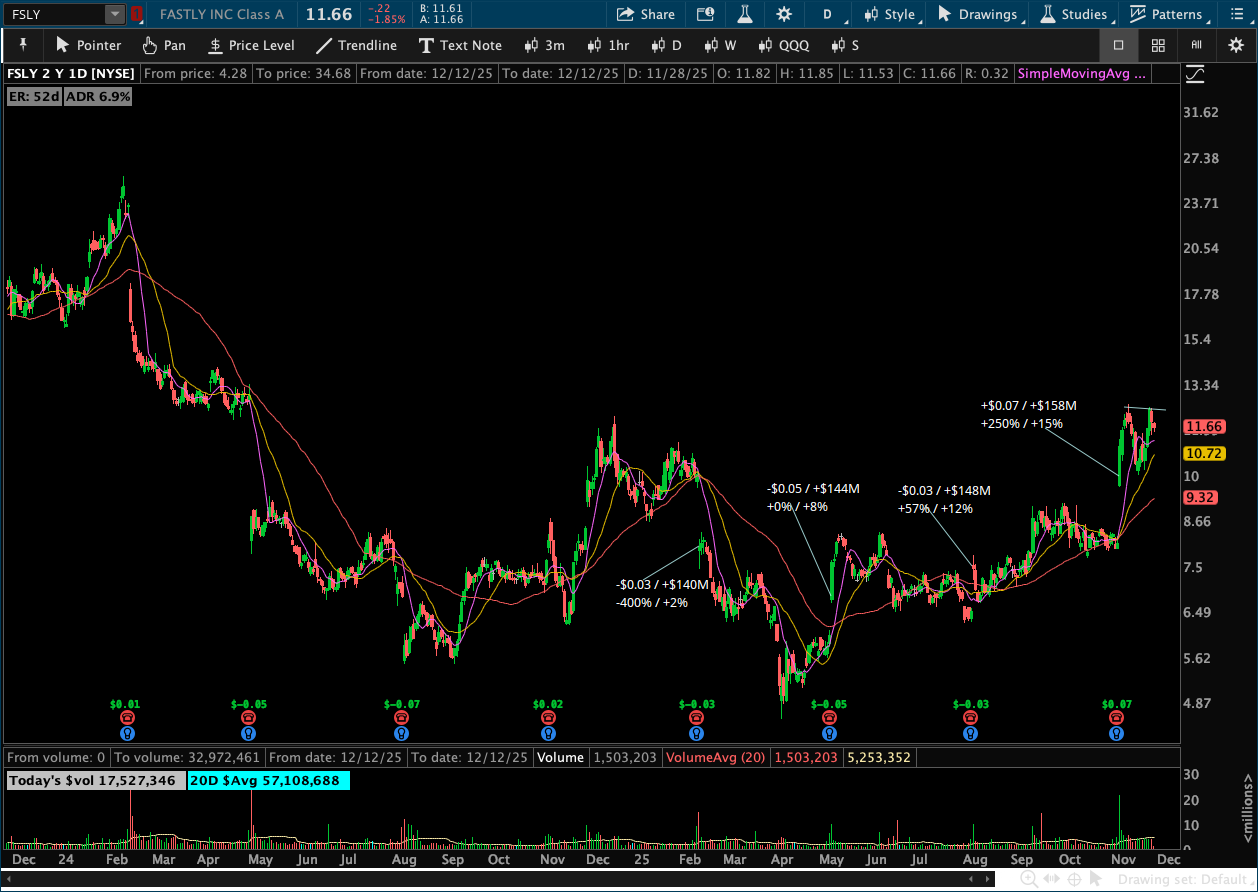

FSLY - Fastly Inc. has been base building for over two years now and is starting to show signs of growth as they just reported a triple digit eps this recent quarter. Their estimates for next year look to be accelerating, and if it catches momentum, it will begin a stage 2 uptrend.

Recent movement is tied to a planned transfer of its stock listing to the Nasdaq Global Select Market and positive leadership and strategic announcements, including a new CEO.

APPN - Appian Corp has reported triple digit eps for three straight quarters in a row and had an episodic pivot on it’s most recent earnings report in November. It is consolidating now and showed little to no signs of weaknes during the market pullback. The liquidity is a little lower on the daily, trades around $25 million dollars a day. Consolidating and letting the moving averages catch up.

The rise is generally attributed to strong recent quarterly earnings and the company’s continuous launch of new AI and automation capabilities within its low-code platform.

CLS - Celestica Inc. has been one of the biggest growth gainers of this year. Recently pulled back to the 50ma, and reclaimed after the market pullback. It put in a tight day yesterdays session, and broke out today. Remains one of the leaders in this market.

The stock is soaring following impressive, above-consensus Q3 results, significantly raised 2025/2026 guidance, and surging demand for its AI-related data center hardware.

Wishing you a great night, and weekend.