Next weeks watchlist remain on stocks that have shown RS, are above the 50ma, and might be building a tight pivot around a moving average I can risk off of.

SNDK - They had a phenomenal quarter with numbers that blew away expectations, and then they got a huge boost from being added to the S&P 500. This is all due to the explosive, non-stop demand for high-performance flash memory needed everywhere from phones to major AI data centers.

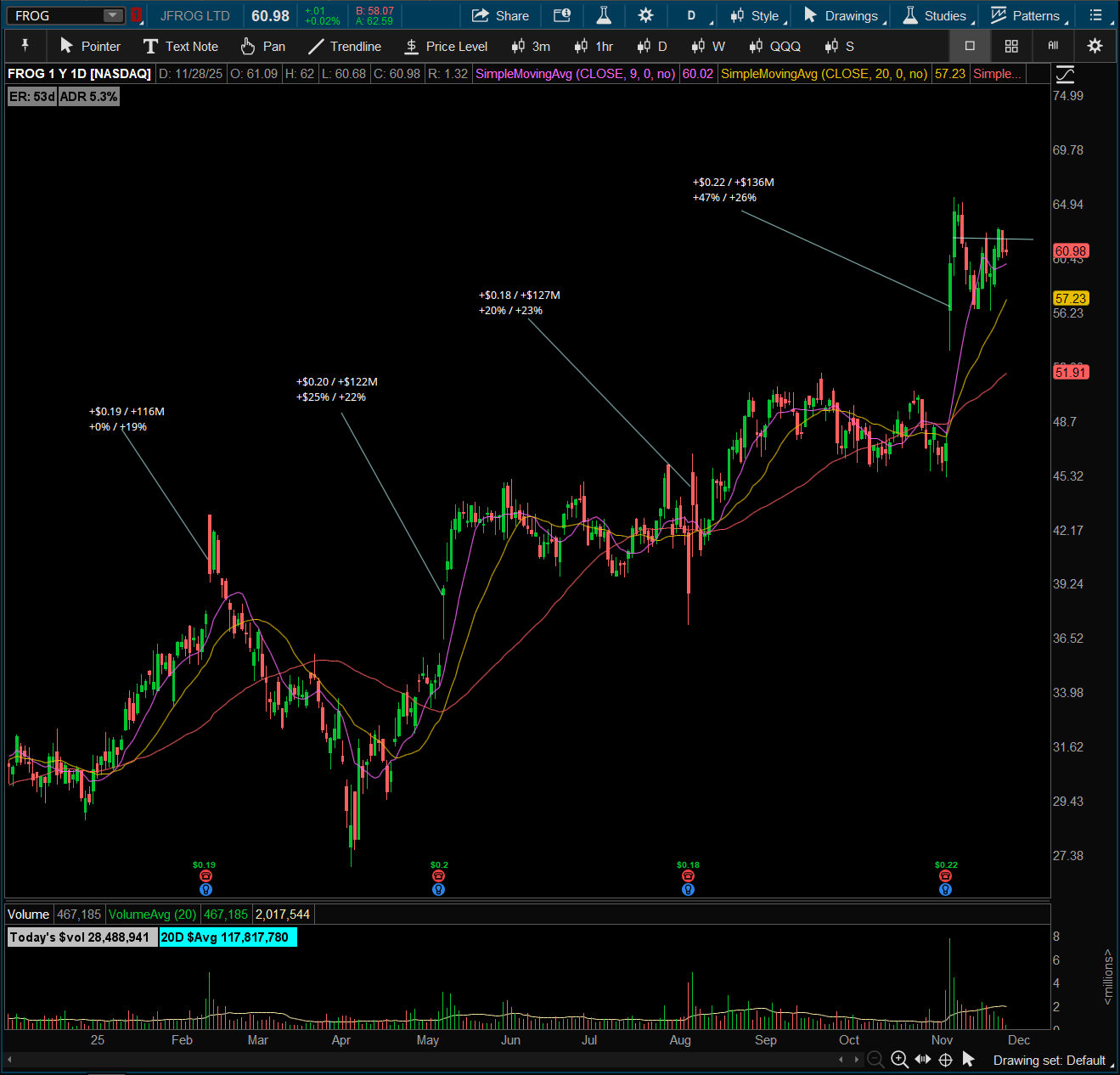

FROG - These guys absolutely crushed their latest earnings report and raised their guidance for the year, which really got people excited about their DevOps and cloud platform. Essentially, they’ve proven they’re a must-have for enterprises building out software, and the market is finally giving them credit for that sustained growth.

ONDS - The stock took off because they showed huge revenue growth, proving their autonomous drone and specialized wireless networks are seriously in demand right now. With a massive backlog of orders, it looks like they are hitting their stride in the crucial Industrial Internet of Things space.

BW - This was a pure-play catalyst: they landed a mind-blowing $1.5 billion contract to build power plants specifically for giant AI Data Centers. That single deal completely changed the narrative, signaling that this old industrial name is now a key infrastructure player in the high-growth AI energy sector.

FSLY - The stock is moving because its specialized edge cloud network is seeing really strong customer adoption and revenue expansion. People are betting that they will significantly improve their margins and continue to capture market share in the critical content delivery and security space.

APPN - Appian absolutely crushed their most recent earnings report, surprising everyone by hitting a GAAP net profit and proving they can be both a growth company and a profitable one. On the product side, investors are really excited because their low-code platform is seeing massive adoption of its AI-powered automation features, which is what enterprises are desperate for right now.

VICR - They’ve been on fire because their power components are absolutely essential for the most powerful AI chips and data center servers being deployed right now. Analysts loved their recent earnings beat and a new licensing deal, which confirms their hardware is integral to the whole AI buildout.

OPEN - Turn around story. Positioning themselves to become profitable.