QQQ

Gapped up over the weekend and got sold essentially all day. Monday gap ups usually lead to chop or a pullback, tough to get positioned into anything new. Index continues to chop around the 50ma, not the best environment for new positions.

10 ma continues to slope down. 20ma and 50ma are flat. The index closed under the 50 today. Unless we get a sharp reversal, I can see it start to slowly drift lower.

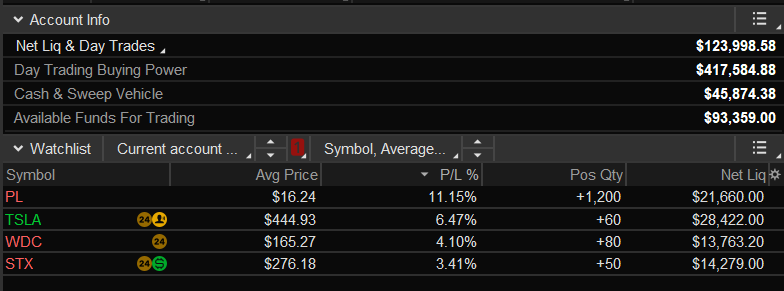

My current risk given the market environment: Half size

What I did today

WL was slim coming into today. Went long one stock on small size and cut it for scratch.

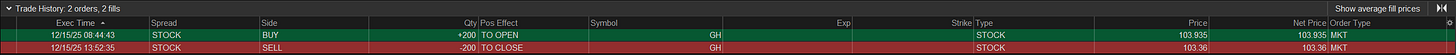

GH has been starting to surf the 20ma recently. Took a small long position around yesterdays high, and sold it for a scratch leading up to the close.

Prints:

Equity + Holdings: