QQQ

After the index closed under the 50ma, it gapped down today. The Q’s tried to rally in the morning session, but got rejected at the 50ma. Net new lows are starting to come in higher than new highs.

10ma continues to slope down. 20ma and 50ma are flat. Not a good environment for swing trading on the long side.

My current risk given the market environment: No trading

What I did today

Sold a lot of my open positions for a gain. One last stock remains in my portfolio.

PL sold my position in it this morning in the 18s. With all of the space stocks getting a colonoscopy, I decided to take the gain.

STX sold the remaining of my shares today. Like the name longer term. With the index living under the 50ma, I don’t want to be too optimistic on any positions.

WDC sold the remaining of my shares in the morning for a gain. It’s not doing anything wrong, the issue is the Nasdaq. If it continues to live below the 50, and go lower, this name will pullback even further than this.

Prints:

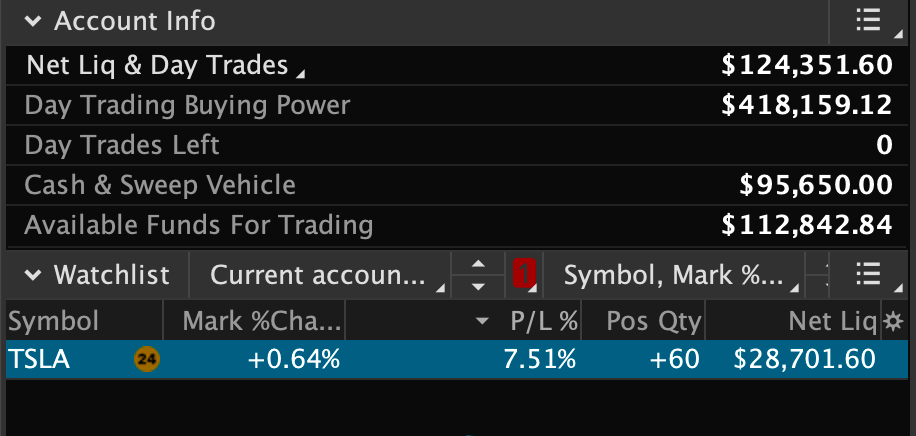

Equity + Holdings:

TSLA is the last one standing in the portfolio. So far it is showing an incredible amount of relative strength.

been a very flat December even the Qs made a big move off the lows. I think more digestion and chop would be healthy for a rally in Q1 2026