QQQ

The index gapped up today above the 10 and 20 and pulled back in the morning session. Most of the stocks that broke out last week held their gains with minimal selling/pullbacks.

The 10 is under the 20 due to the past 10 days, and price ultimately undercutting the 50. As price continues to live above all KMA’s, that should change.

The angle of the 10ma is improving, the 20ma is sloping up and the 50ma is flat. Market conditions are improving.

My current risk given the market environment: Full Size

What I did today

New position. One Scratch.

DXYZ

With space theme in full effect, I found an entry on this name as it crossed back up the range break I was interested in at around $32.60. Stop remains at LOD. DXYZ isn’t a quality name, but it is in theme which makes it part of my stock selection criteria.

AMKR

A stock I’ve been stalking after it had a decent run. The gap up today made it hard to get involved, I bought some shares at around vwap, and let it go when it wasn’t pushing out as I wanted it to. Scratch trade.

Prints:

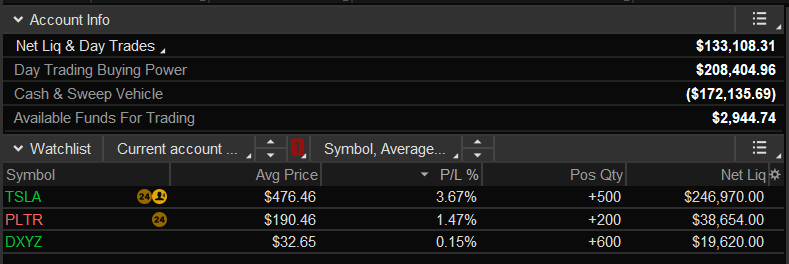

Equity + Holdings: