QQQ

The index gapped down and closed right where it opened.

The 10 is under the 20 due to the past 10 days, and price ultimately undercutting the 50. As price continues to live above all KMA’s, that should change.

The angle of the 10ma is improving, the 20ma is sloping up and the 50ma is starting to turn up. Market conditions continue to improve. Still too early to call it a momentum market, but I do think things can set up for another leg higher.

My current risk given the market environment: Half Size

What I did today

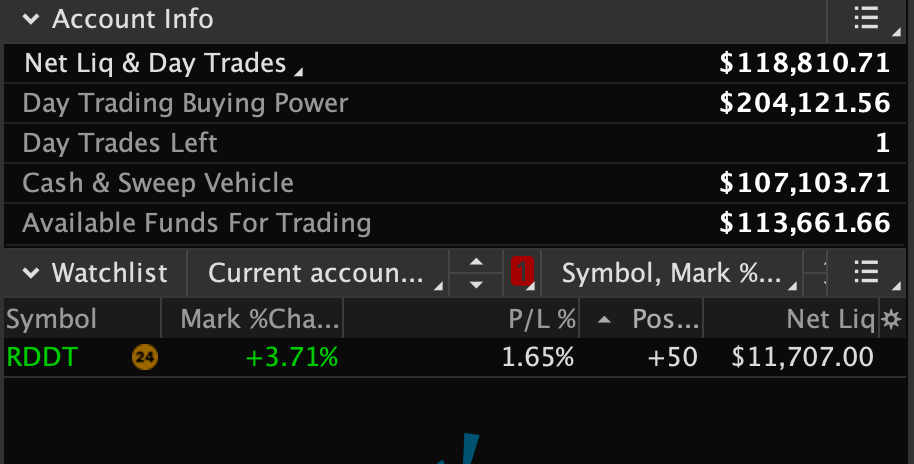

Got hit and stopped out on TSLA and PLTR gap downs. Entered RDDT.

TSLA dissapointed in myself as I added to TSLA in a very aggressive way on the second buy. Essentially overleveraged myself and paid the price today on the gap down. It was working fine and was comfortable during the consolidation. That quickly changed today.

PLTR sold on the gap down. Sized it right so was a normal loss.

RDDT bought on the range break at the 20ma. Sized it to a half size position.

Equity + Holdings: