QQQ

Gapped up overnight and tried to push higher but resulted in some selling.

All moving averages are in sync for an uptrend. A couple days of chop wouldn’t be a bad thing. I would like to see a retest of the 10ma at some point.

My current risk given the market environment: Full size

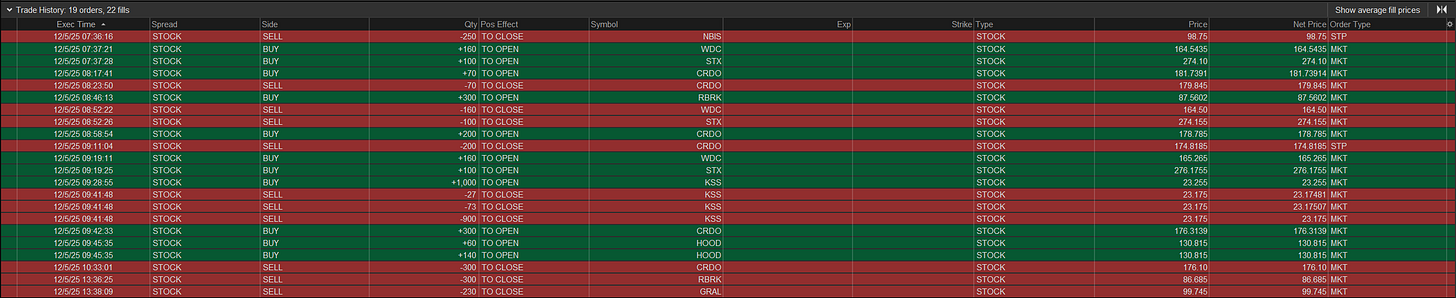

What I did today

Entered some positions, and got chopped up in trying to position myself into CRDO which is something I never do. Paid the price for it.

WDC bought the orb as it gapped up over the range it built at the moving averages. I initially sold it, but bought it back around the same price mid day.

STX same group and trade as WDC.

HOOD former leader broke out 2 days ago. I bought a dip in the 130s and using 127 as my stop. The 10ma is currently at 128. I want to be involved in this stock as it can make some good moves if it gets going.

RBRK bought it around vwap and never really did anything today. Sold it for a small loss instead of keeping it over the weekend.

GRAL pulled back below my entry, gave it all day to rebound but ended up pulling the plug on it for a small loss.

CRDO tried to get positioned long on this one today and was just a mistake. Was trying to get positioned for an inevitable push back out of this base. Not something I’m going to think about going fwd, but thought I should point it out instead of forgetting about it and potentially doing something like this next week. Think I lost a 0.75% of my account on this in total which is not by any standards a ‘good trade’ given it’s not a set up yet.

Prints:

Equity + Holdings:

Thank you for sharing your overall thought behind your attempts to get positioned in a few of these names. Although, not a perfect process, I have been using MACD and Stochastic indicators to help with timing. I'll send you a screen sheet of what I mean on X.