QQQ

Gapped up overnight and and pulled back all day. Breadth was ok today which is good to see.

All moving averages are in sync for an uptrend. A couple days of chop wouldn’t be a bad thing. MA’s are starting to fill in some of the empty space on the daily chart which is good to see.

My current risk given the market environment: Full size

What I did today

Took 2 trades and an add.

CIFR tried to pick this up around vwap after the opening drive and stopped me out. After it based all day, I bought it on a higher high on the 5m using the lows as a stop. Hasn’t done much after that today. $23.3x is the weekly level that can be considered the breakout level.

TSLA added to TSLA via TSLL as it pulled in to the 10ma b/c of a Morgan Stanley downgrade from overweight to equal weight. I only had half size of my position so used the weakness to add. Chart is still in a range so can expect more chop.

Prints:

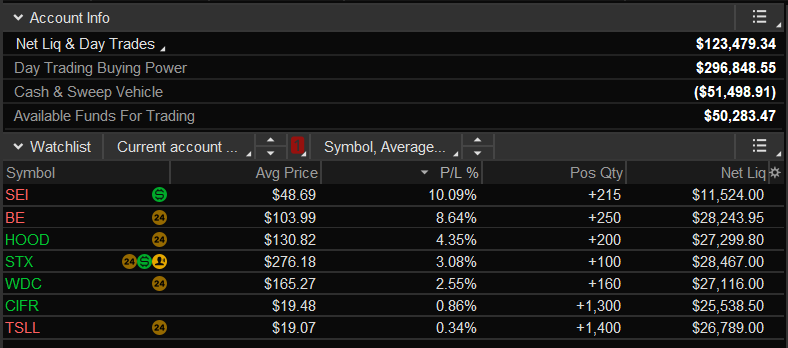

Equity + Holdings:

Most stocks ended up pulling back on me more than I would like. BE SEI TSLL for example. The ADR on those three are all above 8%, with BE being the highest of 13% so sharper retracements are expected.

No trades for the next two days as the rate decision is on Wednesday.