QQQ

Gapped down overnight and got supported with a small green day.

All moving averages are in sync for an uptrend. A couple days of chop wouldn’t be a bad thing. MA’s are starting to fill in some of the empty space on the daily chart which is good to see.

My current risk given the market environment: Full size

What I did today

Tried to get positioned in new things today but chop has made it tough.

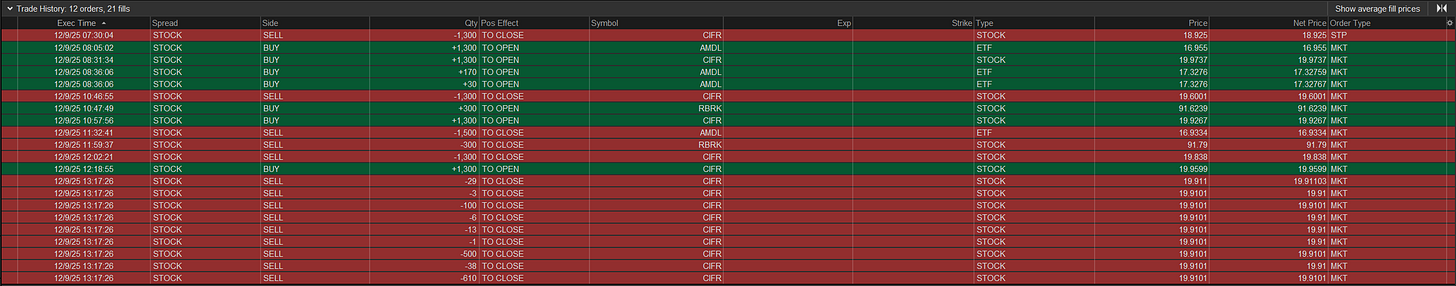

CIFR headache past two days to get positioned to what could be a flag b/o. Tried it a 2 times on standard size around vwap reclaims and got stopped out for small losses. WULF seems to be the leader but it is also very choppy intraday.

AMD tried a long via AMDL. Got stopped out for a small loss as it didn’t push out.

RBRK long was intraday around vwap, closed the trade at the close for a scratch. Ideal entry was the morning drive.

Prints:

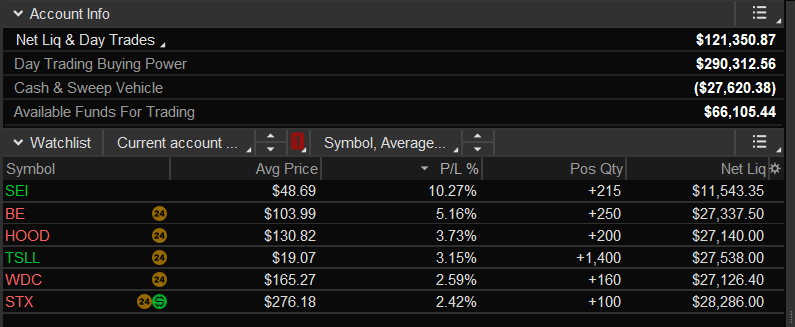

Equity + Holdings:

Chop day. Was up +2% in the morning session, until most names ended up pulling back. Ended up -1.49% on the day. No trading tmrw as FOMC can be extremely choppy.