Daily Review 6.24

Documenting positions taken, or sold today.

QQQ having a very strong gap up and held it’s gains today. Very different characteristic than it’s previous gap ups. Moving forward, I would want price to move away from today. If we start to fade and potentially lose the gap, that could be terrible for new entries. Taking it day by day.

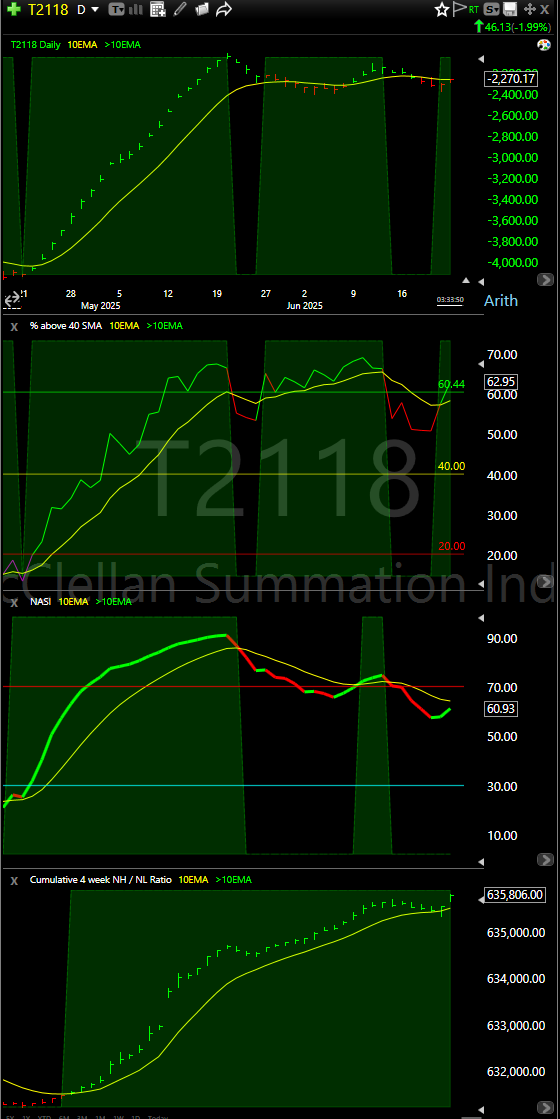

Breadth was also very good on today’s breakout.

Current postitions:

All acting relatively well except for TSLA. Will continue to monitor my positions, and look for valid set ups. If I see no set ups going into the rest of the week, I likely won’t be doing anything.

Here’s my review for today.

Had a few positions I opened today. Some I sold for very small losses so not dissapointed in those. UBER was the best one given the action and how price moved away from my average very quickly.

TICKER: NBIS 6/24

CATEGORY OF TRADE (INCLUDE CATALYST IF APPLICABLE): Flag Breakout

CHART (DAILY AND WEEKLY):

EXECUTION:Chased it a bit over $50 on small size, then looked to add on a higher high.

THOUGHTS ON THE TRADE / LESSONS LEARNED: I like the pick up in volume, and I also like how it shook some ppl out today intraday (not shown in tradervue ^^). Will be holding overnight as have a cushion.

---------------------------------------------------------------------------------------------------------

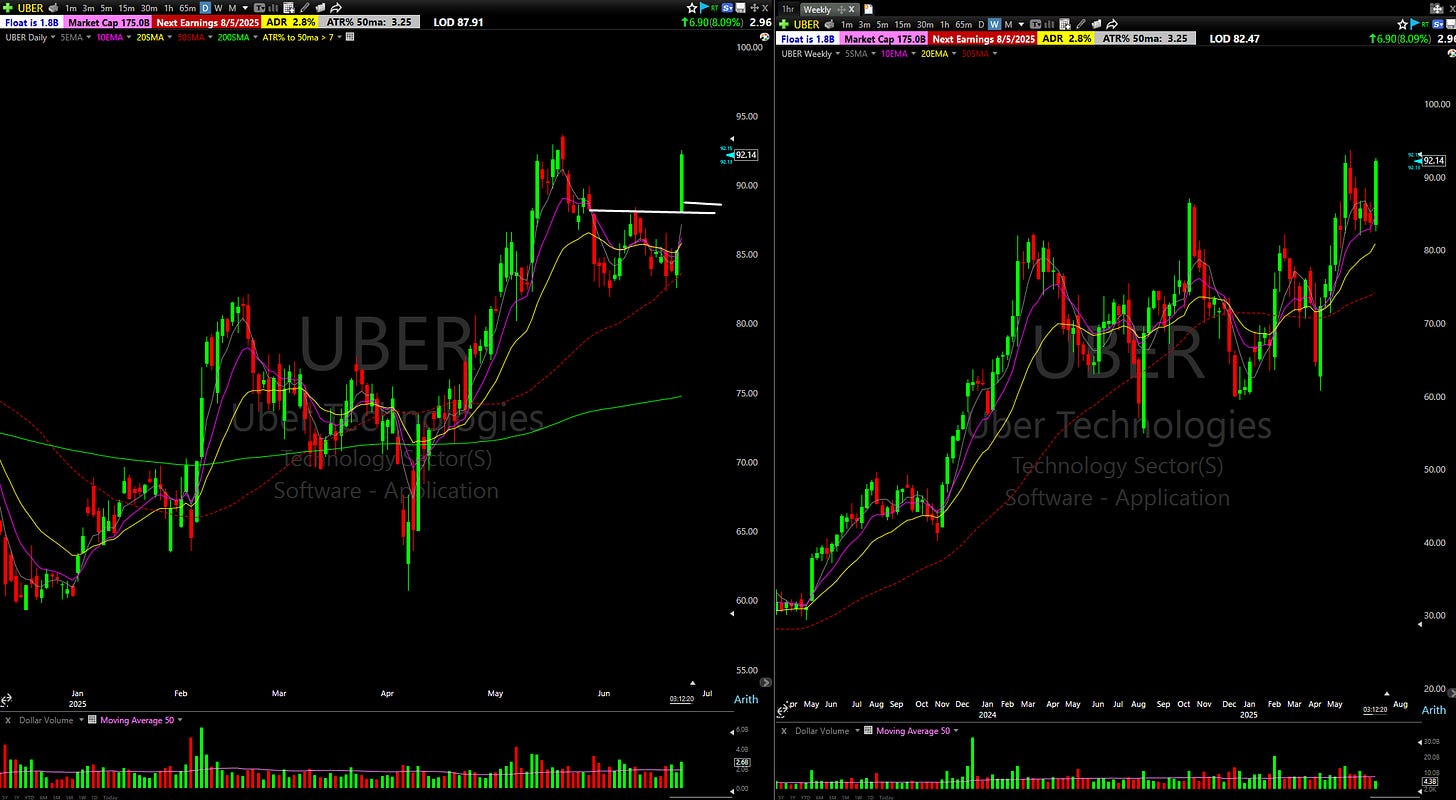

TICKER: UBER 6/24

CATEGORY OF TRADE (INCLUDE CATALYST IF APPLICABLE): Low Base Breakout, Waymo news being rolled out in Atlanta

CHART (DAILY AND WEEKLY):

EXECUTION: Bought the premarket high breakout. Stop LOD

THOUGHTS ON THE TRADE / LESSONS LEARNED: Chart, catalyst, and entry tactic were all valid. I'd say this is as close to 5 star it can get.

---------------------------------------------------------------------------------------------------------

TICKER: AVGO 6/24

CATEGORY OF TRADE (INCLUDE CATALYST IF APPLICABLE): Got upgraded

CHART (DAILY AND WEEKLY):

EXECUTION: Let the market settle and after AVGO pulled into vwap and held, I entered a position. Didn't do much by the close so closed the trade out for a small loss.

THOUGHTS ON THE TRADE / LESSONS LEARNED: OK looking trade, I think overnight gap messed up the entry given how choppy by nature the stock is. Looked a lot better yesterday for an entry than today.

TICKER: ODD 6/24

CATEGORY OF TRADE (INCLUDE CATALYST IF APPLICABLE): Low Base Breakout

CHART (DAILY AND WEEKLY):

EXECUTION:

THOUGHTS ON THE TRADE / LESSONS LEARNED: Let the market settle given the gap, once ODD went through the $75 offering high I put a position on. Decided to cut the trade given no follow through, also stock trades very thin.