Daily Review 6.23

TICKER: TSLA 6/23

CATEGORY OF TRADE (INCLUDE CATALYST IF APPLICABLE): Low Cheat Flag Breakout, Robotaxi launch in Austin

CHART (DAILY AND WEEKLY):

EXECUTION: Bought it over pivot highs of 332-333. Stop LOD

THOUGHTS ON THE TRADE / LESSONS LEARNED: Chart was set up for a break out, and catalyst made it "easy" for price to get away from my average as soon as possible. Was able to get a full 25% position in TSLA as the stop was so tight.

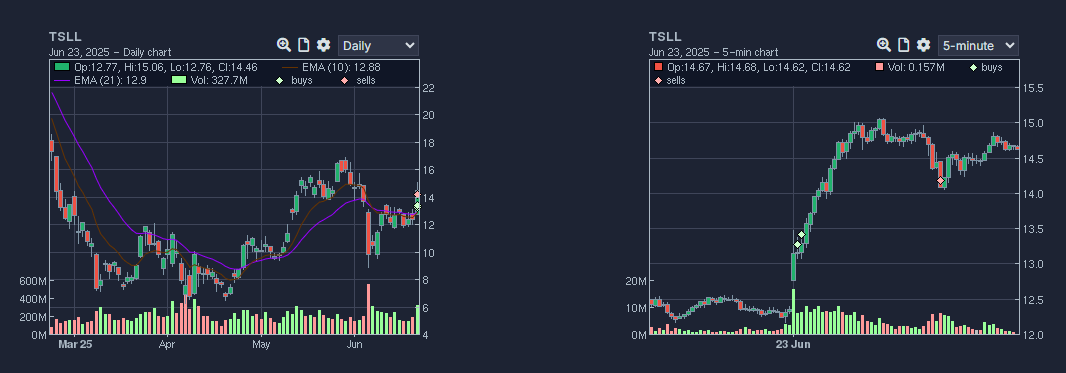

TICKER: TSLL 6/23

CATEGORY OF TRADE (INCLUDE CATALYST IF APPLICABLE): Similar to TSLA above

CHART (DAILY AND WEEKLY):

EXECUTION:Similar entries as TSLA, however sold out a bit early due to market pullback as insurance for my TSLA trade.

THOUGHTS ON THE TRADE / LESSONS LEARNED: Wasn't going to swing TSLL to begin with as already had TSLA. Sold it a bit premature given the market pullback and would rather just be in the main stock instead of dealing with decay.

---------------------------------------------------------------------------------------------------------

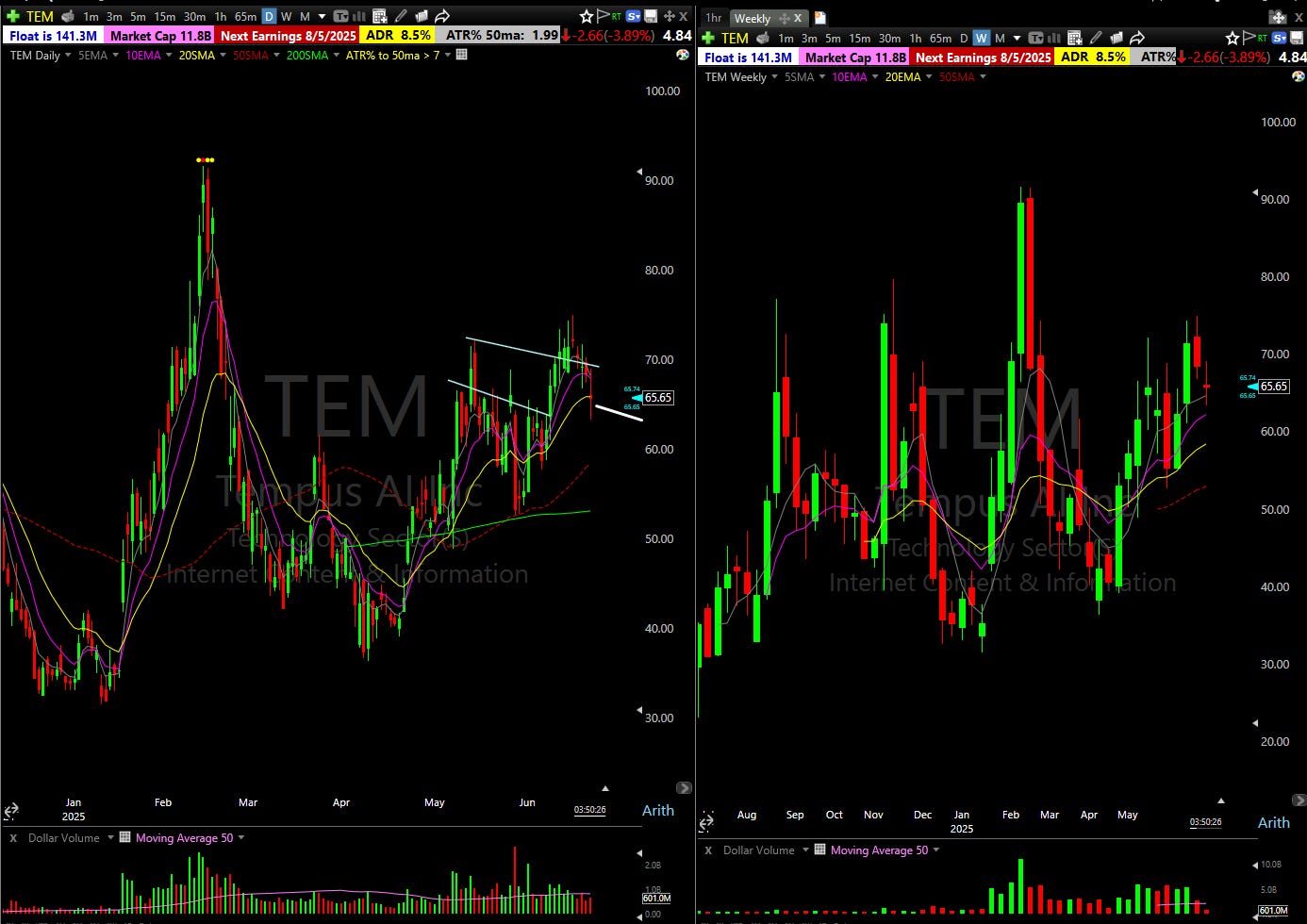

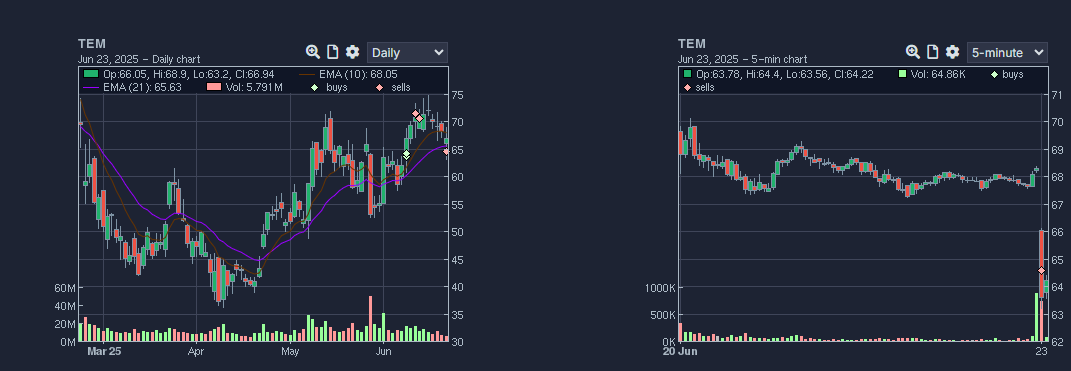

TICKER: TEM 6/28

CATEGORY OF TRADE (INCLUDE CATALYST IF APPLICABLE): Closing Trade

CHART (DAILY AND WEEKLY):

EXECUTION:

THOUGHTS ON THE TRADE / LESSONS LEARNED: Closed remainder of shares on gap down.

---------------------------------------------------------------------------------------------------------

TICKER: WING 6/23

CATEGORY OF TRADE (INCLUDE CATALYST IF APPLICABLE): Post earnings MAPB Consolidation Breakout

CHART (DAILY AND WEEKLY):

EXECUTION:

THOUGHTS ON THE TRADE / LESSONS LEARNED: Bought WING on the initial push over the range of 352.5's with a stop at LOD. Once the market started to roll over I decided to cut the trade for a small loss, and decided to buy it back as the market started to gain strength. Closed strong on the day.