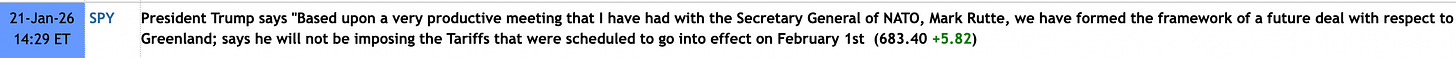

Don’t usually send out an update but thought it was worth it after todays news. Towards the middle of the day the news below hit the tape and stocks bounced off their moving averages which allowed me to stay in my trail positions shown at the end of this post.

No one knows what is about to happen or going to happen in markets. Small pieces of news like this are forgotten months from now. It matters today given the context of where we are in the index. However, a few months or years from now, it will be a whole different situation.

In closing, what I can control is my position sizing, risk tolerance, and rules. Outside of that, I don’t have an edge on trying to predict what the president will do next. My job as a trader is to focus on themes, and stocks with thematic OR game changing news. That’s it.

Ok here’s the update after today.

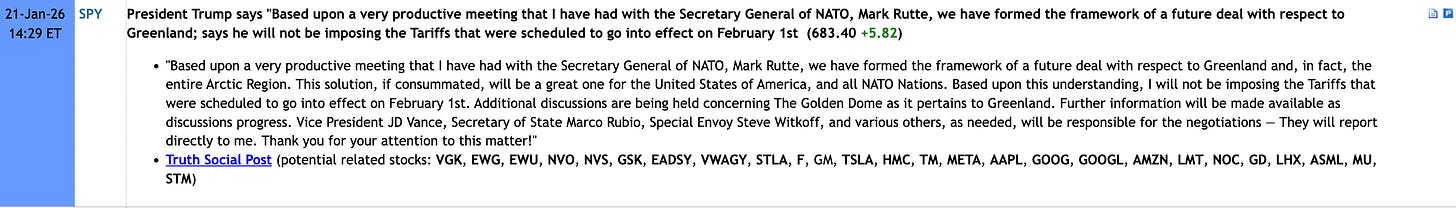

QQQ

Gapped up and got bought up in the morning session. In the afternoon, the index was about to roll over, it even went red at some point until the news hit the tape:

That caused a flurry of buying across all stocks. The strongest names continued higher, or wicked off their moving averages.

The 10 is over the 20, but can change given the move down.

10 is sloping down, 20 and 50ma are flat.

This is an environment where being in the strongest groups is the only way to make progress. If there were no strong groups or themes, then it would be a no trade environment.

My current risk given the market environment: IF we get back over the 50, and there are good setups in strong themes - Full Size.

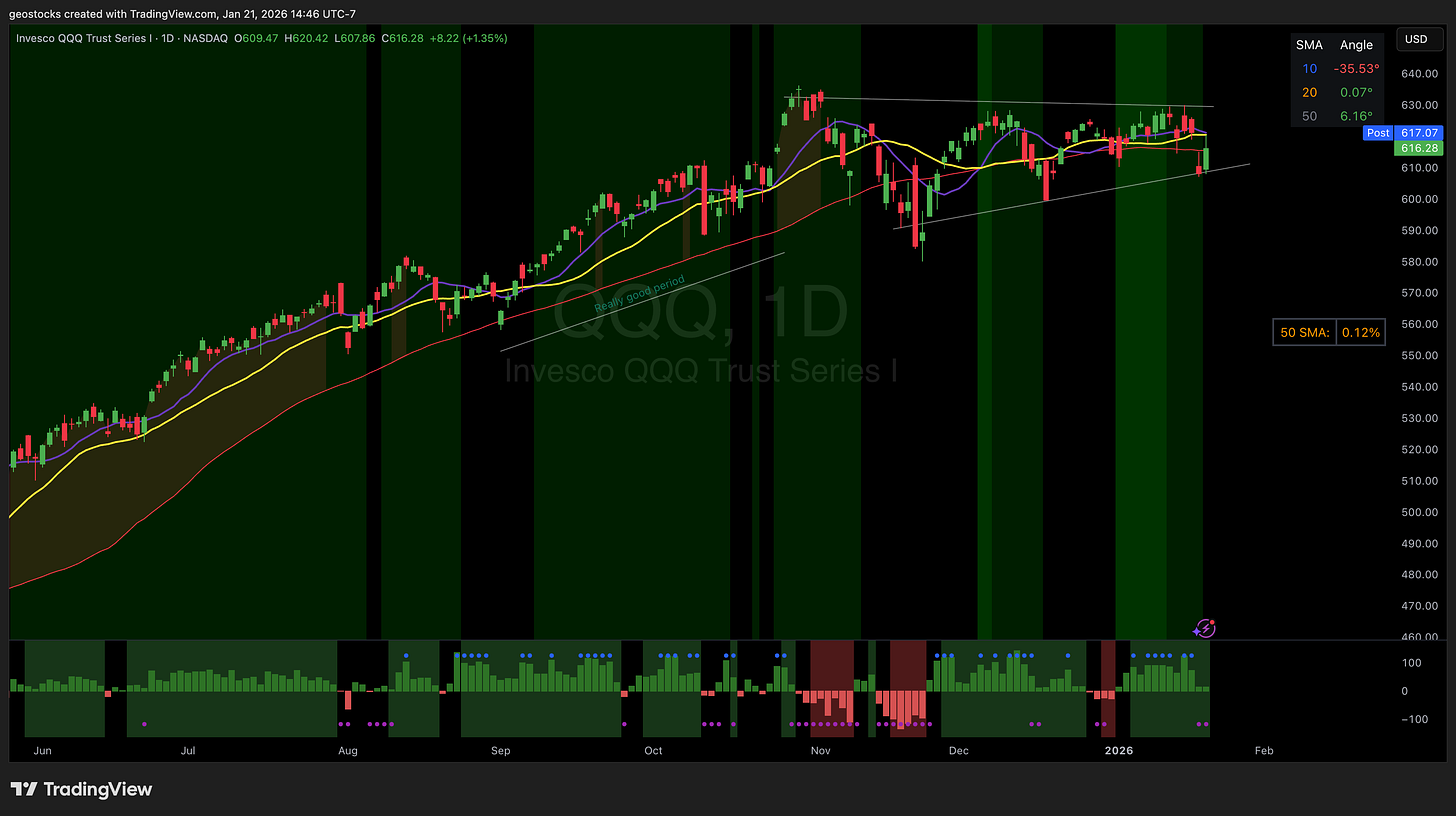

What I did today

Took partial profit, made some new trades.

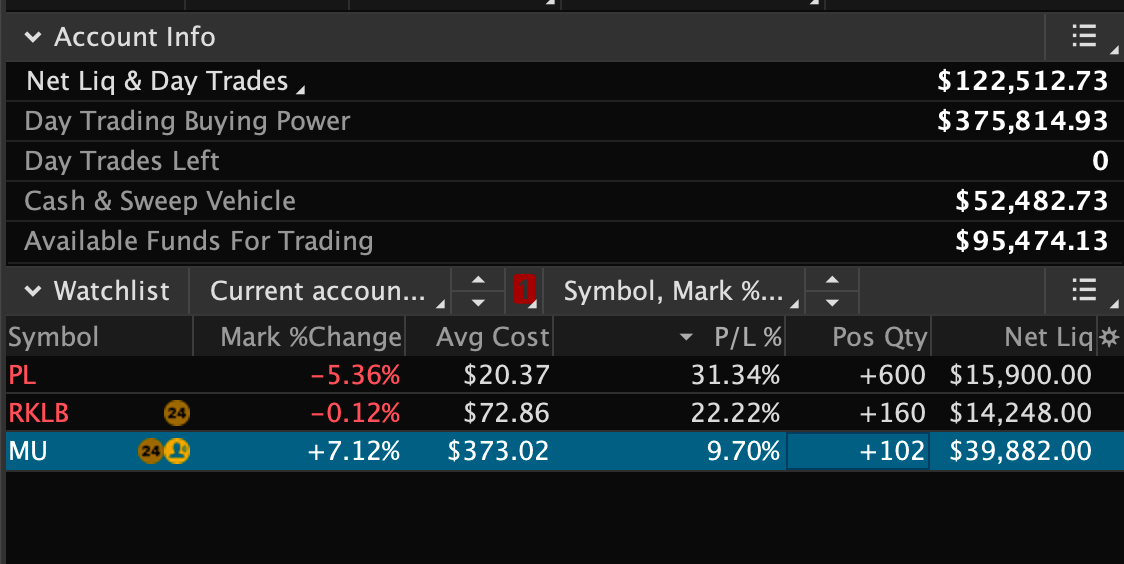

MU was my biggest position in my portfolio and for good reason. It is the leading megacap stock that is in the highest demanding theme: Memory. I was able to get a price that was 1.2% away from my initial stop on Jan 16 which allowed me to get in 60% position. In these situations I’m a little quick to derisk which I did today, so I sold half of my shares and keeping the rest and will be using a moving average to trail the rest. Ideally I can use the 20 if it gets over my average.

SIDU tried this one as it was crossing over red to green. Quickly sold it for a small loss when it pulled back as I wanted it to work right away. Space Theme.

HUT I am currently bullish datacenter infrastructure stocks like HUT, APLD, RIOT, GLXY as they are all showing strength working up the right side of their bases. My first buy was shortly after the open, and quickly sold it for a small loss as it was pulling back sharply. I let it settle and bought it again as it crossed over vwap and yesterdays high.

I ended up getting stopped mid morning.

Prints:

Equity + Holdings:

Things can always change on a dime. It’s worth being at the screen, or at least keeping a pulse on things by scanning and reviewing at the end of each day.

Stocks that are moving as a part of group are strong… Theme. Theme. Theme.