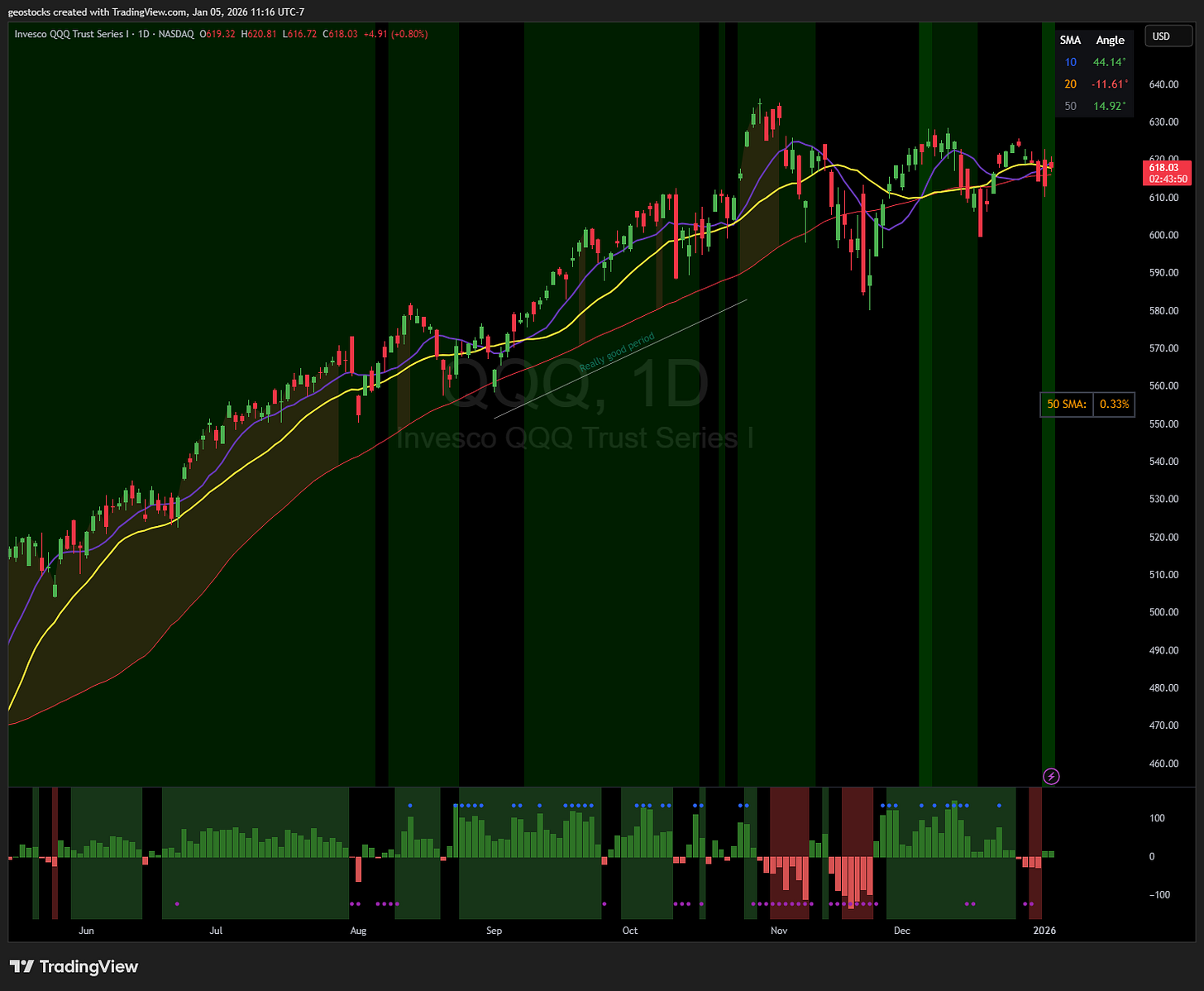

QQQ

The index gapped up over the weekend and held most of it’s gap during the morning session.

The 10 is over the 20. The angle of the 10ma and 50ma are sloping higher, the 20ma is sloping slightly down. We are still in this sort of chop phase as the index hasn’t made a meaningful move in either direction.

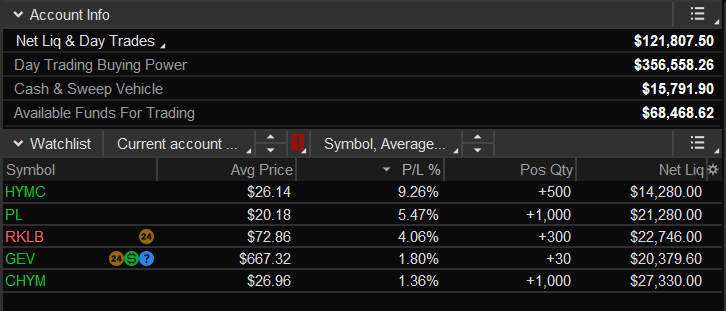

My current risk given the market environment: Full Size

What I did today

Got stopped out on a buy from Friday. Entered two new positions.

COHR got stopped out today after a strong move / close from Friday. All of the AI optics names are having big pullbacks. Probably needs a lot more time to rest and set up again.

HYMC new position from today. Silver name that is moving with the entire group. Was able to sell at my first target today so will be trailing the rest of my position.

CHYM new IPO that has been basing for a couple of months. Entered the range break today.

Equity + Holdings:

That’s all for today.