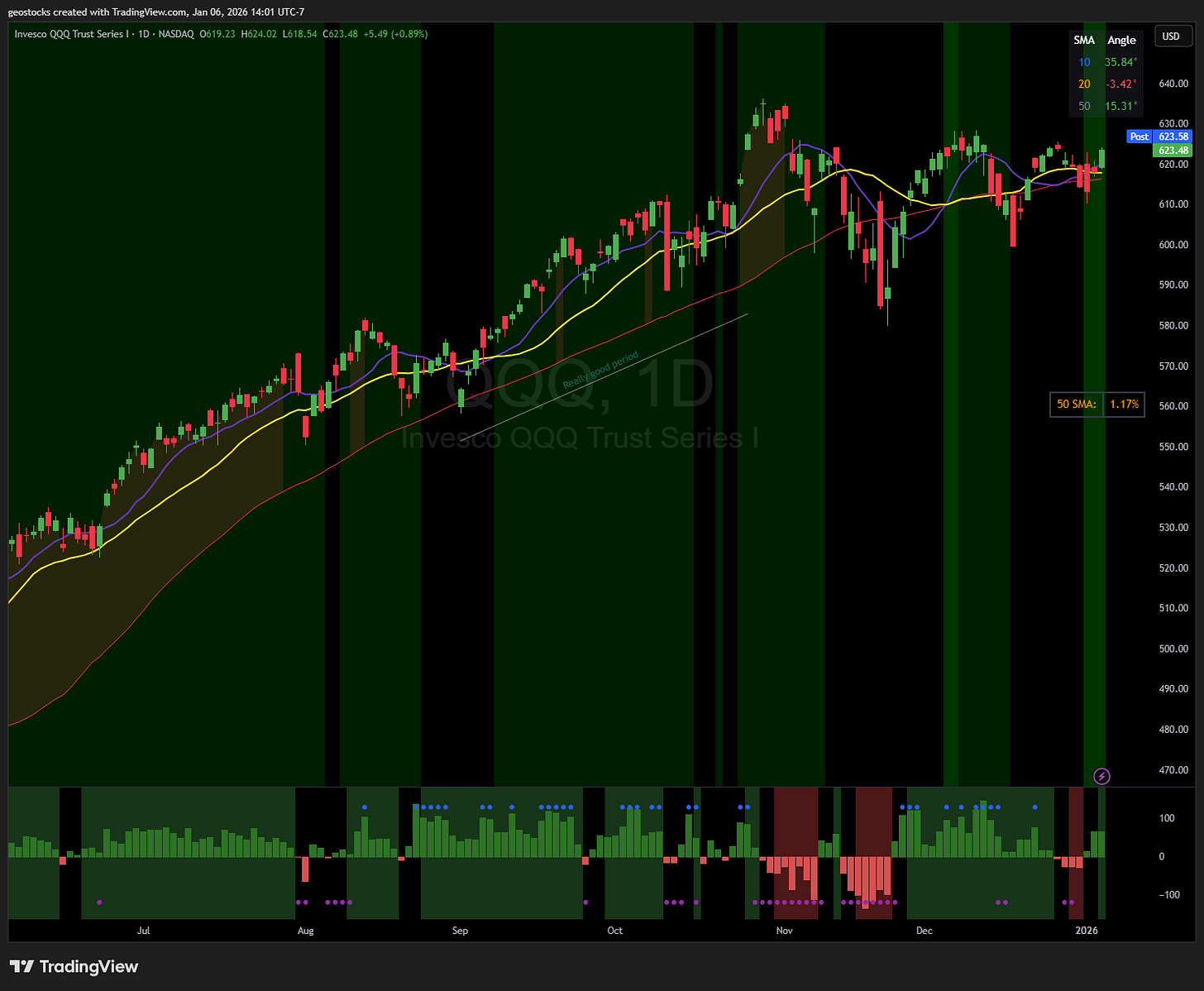

QQQ

The index gapped up overnight and closed strong marking the first attempt at breaking out higher of this consolidation it’s been in for the base 2-3 months.

The 10 is over the 20. The angle of the 10ma and 50ma are sloping higher, the 20ma is flat after today. This is the first signs of a potential move higher in the index, and certain stocks are also showing continuation higher which is good.

On top of all that, there is a very positive breadth reading today which also adds to the overall story. We will see if this ends up being the beginning of the next leg.

My current risk given the market environment: Full Size

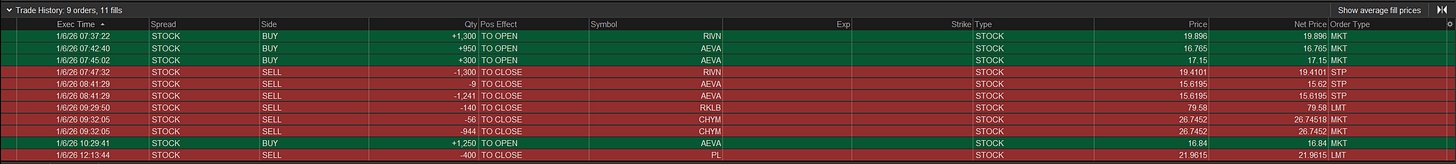

What I did today

Got stopped out on a buy. Entered a new position. Took some profits.

CHYM new IPO that has been basing for a couple of months. Entered the range break yesterday and stopped out today for a scratch

AEVA tried it twice on the NVDA partnership. Got stopped out for a full sized loss in the morning, then rebought it as it was reclaiming vwap around lunch time. Highest volume ever today.

RIVN has been strong since it’s earnings announcement in November. Tried it for a range break today and got stopped out. Still on focus list as it’s putting in higher lows.

RKLB took first profit on this name today. Day 3 and official b/o move over 80. Trailing the rest of my position.

PL same thoughts as RKLB. Trailing the rest of my position.

Prints:

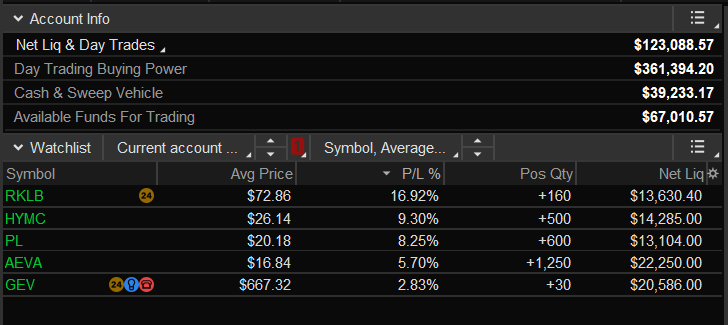

Equity + Holdings:

That’s all for today.

what a U-turn for GEV