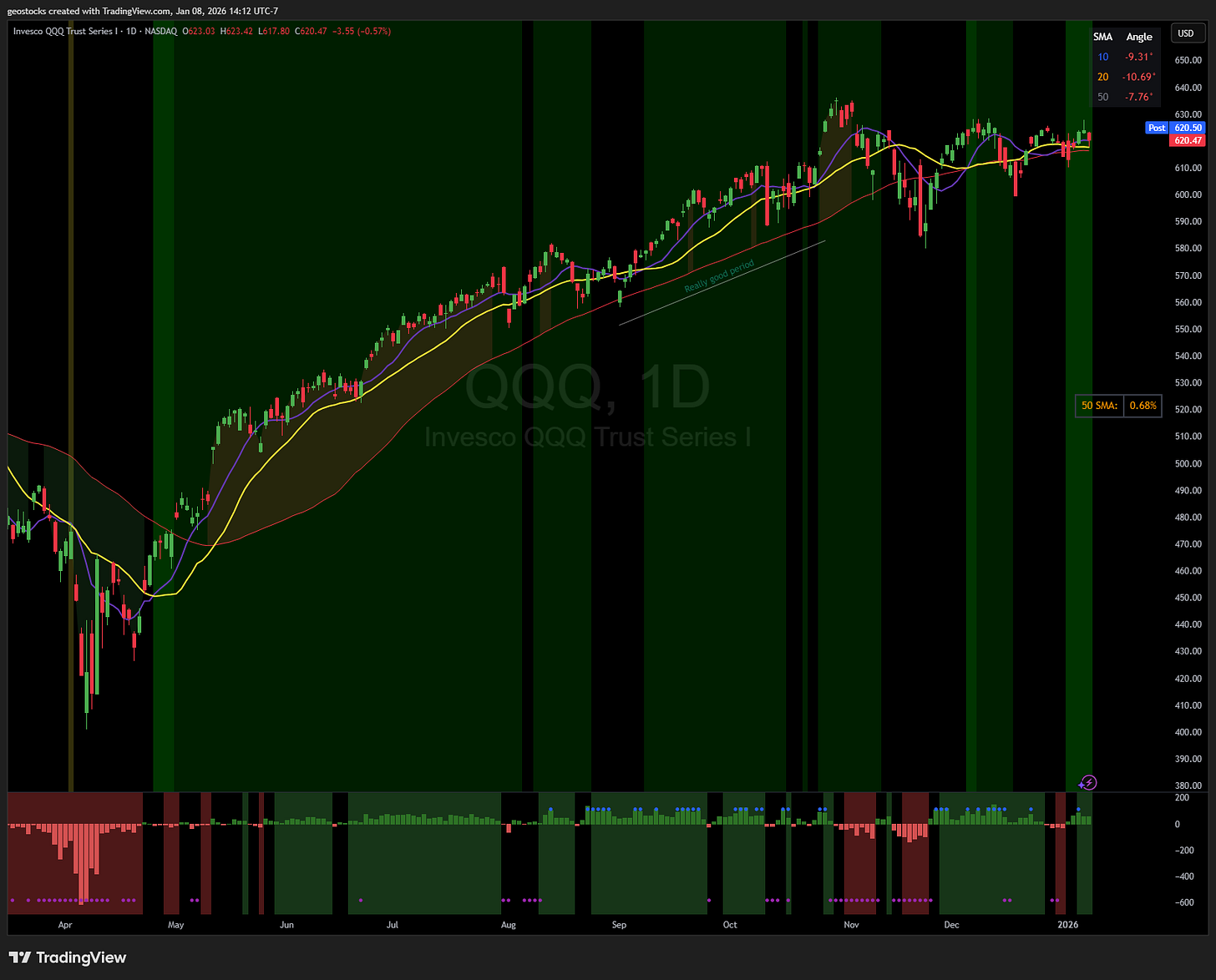

QQQ

The index tried to break out of it’s vcp pattern higher yesterday, closed weak, and today there was further weakness with tons of expectation breakers in growth names + themes.

The 10 is over the 20. First time we are seeing the slope of the 10 and 20 flatten / turn down. After yesterday’s b/o attempt, this is the reality of the chop we have been in. Given that info I’ll be scaling my size down. Even though I don’t see anything to do for tomorrow.

Another positive breadth reading today. Could just be certain mega caps holding the index back from advancing.

My current risk given the market environment: Half Size

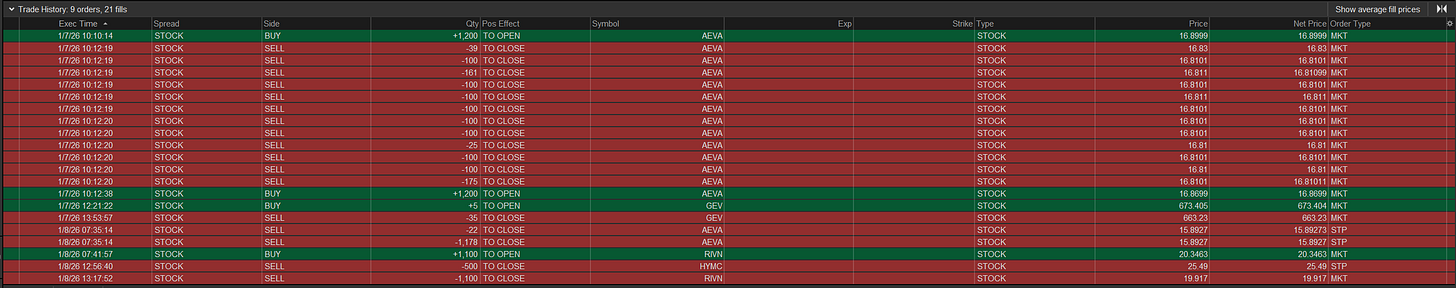

What I did today

Got stopped on a trail + RIVN and AEVA.

HYMC stopped me out at my hard stop on the remaining half of my position. Glad was able to take some gains on the move up.

AEVA got stopped out on the morning flush, again. Think I’ll leave this one alone. 0/3 on this name.

RIVN strong day and gave it all back. Cut it before it turned into a full loss.

Prints:

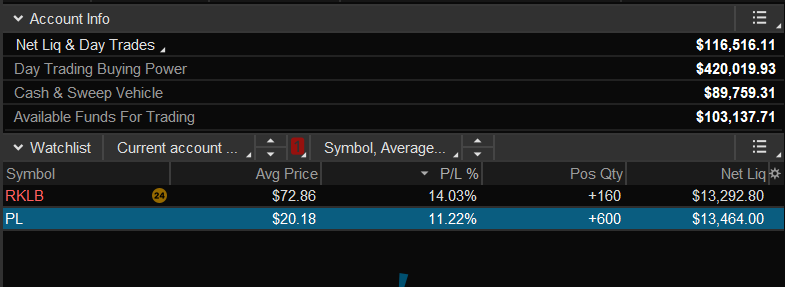

Equity + Holdings:

Lots of stop outs past 2-3 days. I’m starting the year down 1%. Not bad all things considered. If the market was ripping with tons of stocks, and I was down 1%, I think I’d be a bit more frustrated. Given the fact that we’ve been chopping around, this is not a bad position to be in. We’ll see how the next few days play out.

really tough market. Many hard reversal.