There was a lot of chop this past week.

Some stocks pulled back to their rising 10 or 20ma. Others gave back their move.

It has not been smooth sailing since we got up over the 50ma at the beginning of December.

QQQ looks very vulnerable at the 50ma. Primarily led by the megacap stocks pulling back. Even though there might be some stocks setting up, my priority is to align myself with the index on the long side. With price being under the 10, and gut checking the 20 and 50, I’ll be scaling any new trades down to half size. If we start to get under the 50ma, or gap under it tomorrow, I won’t be looking to take anything new.

IWM leading which is where the most bullish action has been recently.

Stocks

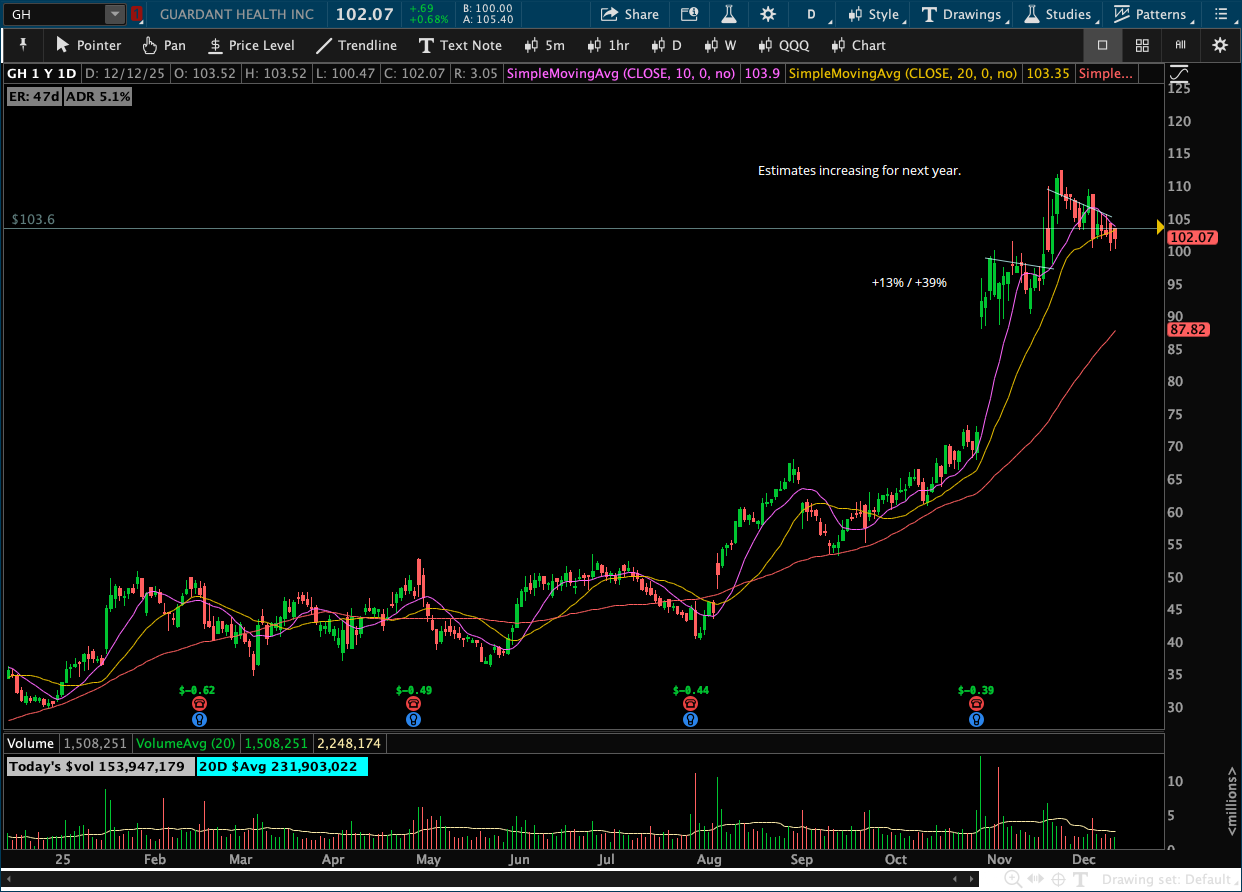

GH being supported at the 20ma. Waiting for a range break to enter long. The company is experiencing strong fundamental growth with its oncology and innovative cancer screening tests, which has prompted it to raise its full-year sales outlook.

KSS is flagging and surfing the 10ma. Watching for a range break. Shares jumped following the catalyst of naming a permanent CEO and reporting better-than-expected third-quarter results, driven by improved margins and traffic.

TE pulled back on a stock offering. Surfing the 10ma. Watching the inside day high. As a provider of connectivity and sensor solutions, TE Connectivity is fundamentally leveraged to long-term secular trends in electrification, data, and automation.

PACS pushed out off the 10ma. Will be watching to see if it puts in a bigger flag on the daily to take long. The stock has seen a significant run following its IPO, with recent strength attributed to the general story of the company’s strong revenue growth and high projected growth rates for operating and net income in the coming years.

LQDA has been trending on the 10ma, waiting for some tightness. Big estimates for next year. Liquidia has seen a strong move, driven by the story of positive analyst sentiment and high price targets ahead of its potential commercialization of a key pulmonary hypertension drug.

MU pulled back back through the breakout. Will be watching to see if it can start to rise the 20ma and build a good set up to take long. The stock’s strength is a fundamental story driven by surging, ‘unprecedented’ demand for its High-Bandwidth Memory (HBM) chips, which are critical components for the AI data center buildout.

ASTS has been one of the big space theme stocks that has rallied recently. We are getting a well deserved pullback. Still in it’s base, could get a base and break above 85, or pick up off an MA if it builds a good range. The stock is driven by the exciting catalyst and long-term story of building a space-based cellular broadband network and upcoming launches like BlueBird 6 to connect unmodified mobile phones globally.

PATH watching for some higher lows off the 10ma, and a range break to take long. UiPath’s strength is based on the broader fundamental theme of surging demand for modern, AI-powered automation software, which translated into strong recent quarterly revenues.

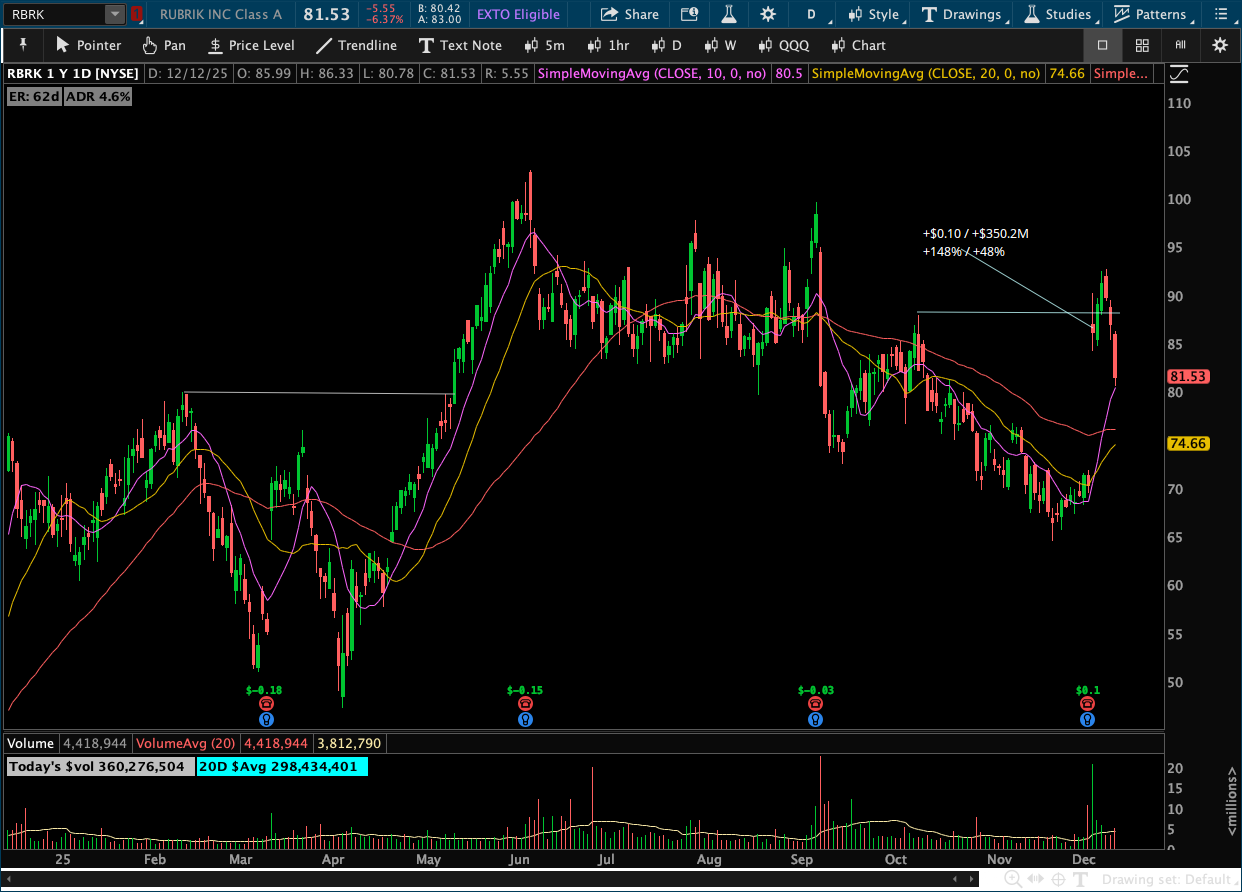

RBRK pulled back to the 10ma on blow out earnings. Kind of a choppy name unless it’s taken from the beginning of it’s move. The stock saw a massive move following the catalyst of a robust Q3 earnings beat, an inflection point to profitability, and strong growth in its Cloud Annual Recurring Revenue (ARR).

APP pulled back to the 10ma and undercut it. One of the biggest growth names from the past 2 years. Watching for a cup and handle. AppLovin is benefiting from the fundamental story of its evolution into an AI-driven, multi-channel advertising powerhouse, highlighted by strong revenue, expanding margins, and massive free cash flow generation.

TTMI has shown RS vs the market and estimates are increasing for next year. Pulled back to the 10ma. The recent share price momentum is built on the story that TTM is fundamentally positioned to capture significant demand for advanced Printed Circuit Boards (PCBs) used in AI and cloud infrastructure buildouts.

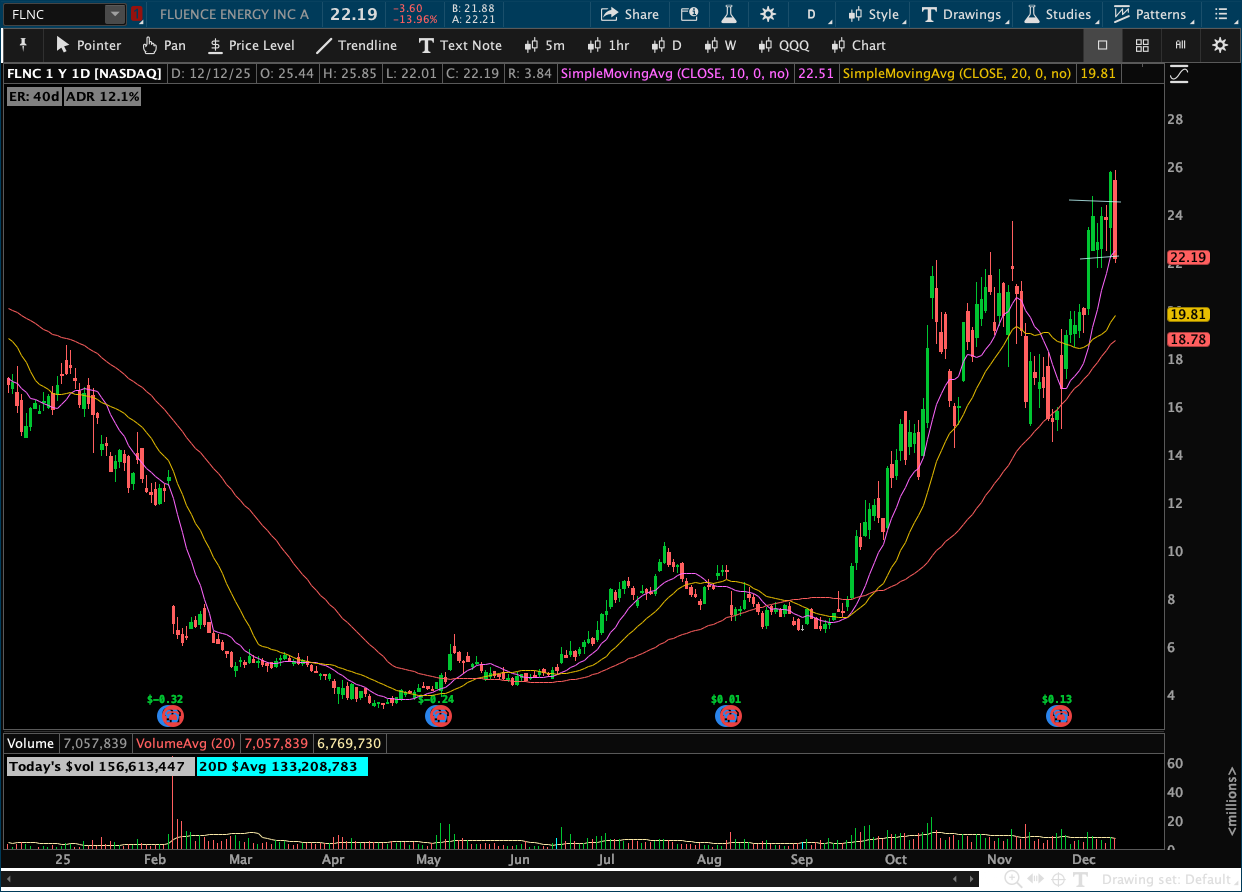

FLNC failed breakout and pulled back. Watching for a better set up. Fluence Energy’s price surged on the catalyst of strong analyst upgrades and high price target increases due to its high growth rate and better visibility into improving gross margins.

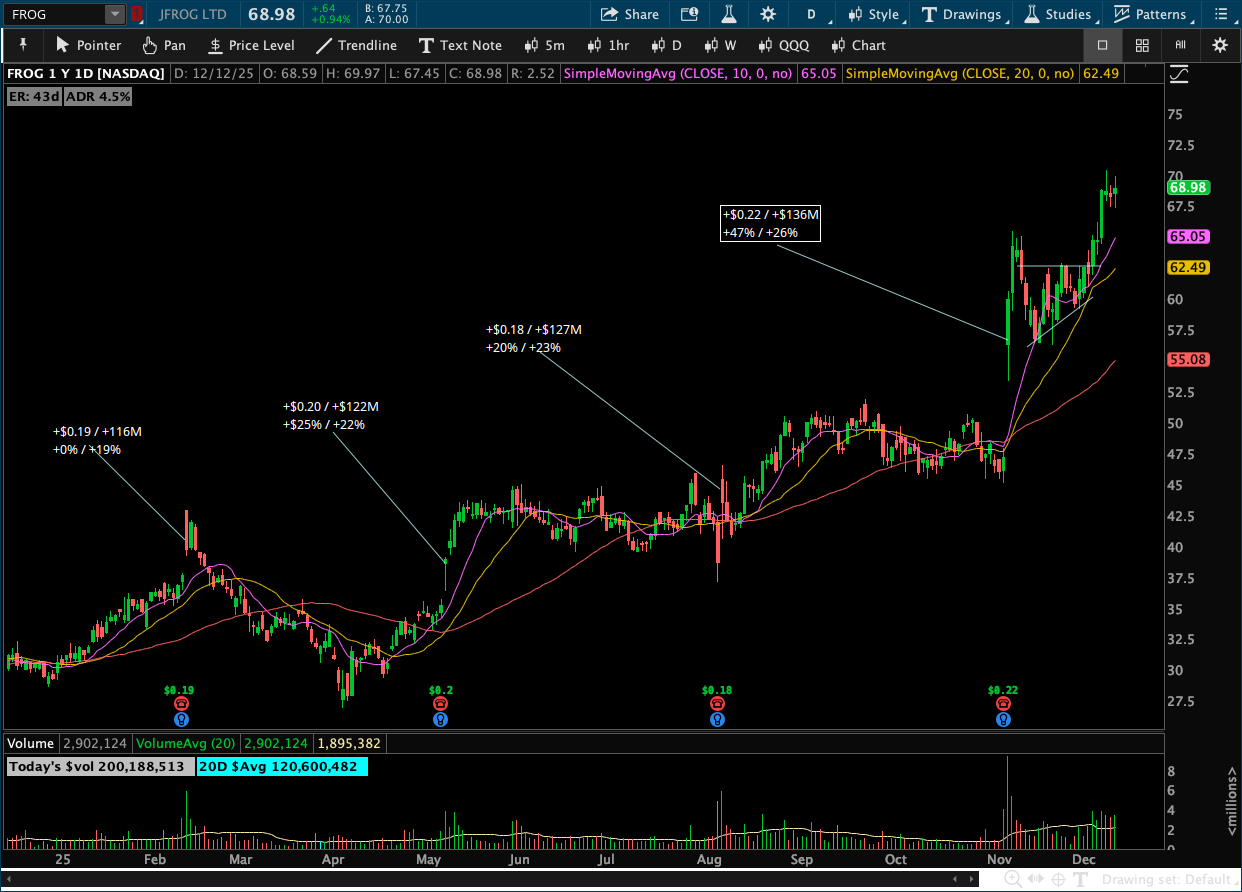

FROG pushed out of it’s 1 month base and found momentum. Has put in some tight days with the market pulling back in to the 50. JFrog’s strong performance is attributed to the fundamental strength of its software supply chain platform, particularly the robust 50% growth in its cloud business which is outperforming expectations.

Brilliant insights; what further conditions would you typically require before considering new trades if we dip below the 50ma, this is quite illuminating.

love the write up.