After what seemed to be a doomed week, things quickly changed after Thursday. It’s important for me to have opinions in the market that are loosely held, and be ready with a good list of stocks in case things turn around. The stocks showing the most relative strength, are usually the ones that make their advances once the pressure is relieved. Lots of good stocks made strong moves on Friday, I was only looking at 1 new position to start to get involved (PLTR).

It has not been smooth sailing in December. However, a reduction in position sizing and not trading when the index is under the 50 has kept me relatively safe.

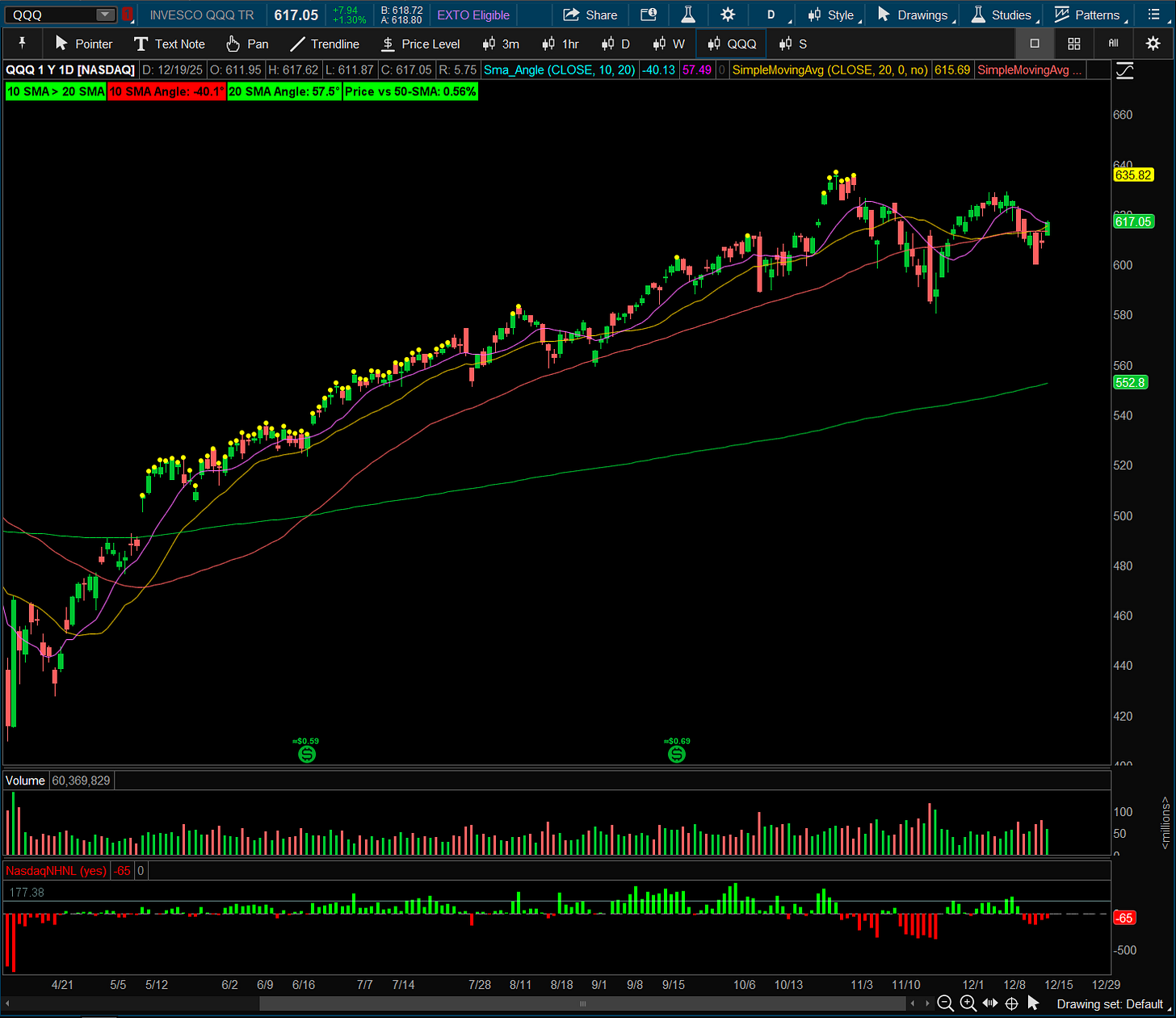

QQQ

Got back over the 50ma on Friday with tons of stocks having bullish responses once the pressure of the index was taken off. The 10 continues to be over the 20, the 10ma angle is sloping down only b/c of the last 10 days being down days, but the 20ma has turned UP for the first time in a while. As long as we continue to push out from here, should start to see the 10ma start to turn up as well.

IWM

Is resting right on the 20sma without a gut check of the 50ma. It looks great if it can continue out of this small pullback.

Stocks

I’ll start with stocks showing significant RS, and may be worth to put on watch for the next few weeks. At the end I point out the stocks that I have some alerts set in that may be looking for an entry.

Space names have really picked up in bids and volume. The next few charts are just meant to point them out.

COHR

Strength is driven by surging demand for AI-related data center infrastructure and the launch of a 300mm silicon carbide platform for high-efficiency cooling in AI hardware. Leading stock in this run that has pulled back and starting to setup at the 20ma. Friday could be considered an entry as it broke out of an inside day. Keeping in on watch.

APP

The stock has soared due to massive growth in its AI-driven advertising technology (AXON 2.0) and a strategic pivot toward a high-margin, pure-play software model. A textbook cup and handle in a leading growth name in the software space. Watching for some tightness to get involved.

VIAV

Robust performance follows a series of positive earnings surprises and successful diversification into the high-growth data center and aerospace/defense sectors. Watching it for some tightness at the 20ma. Has built a series of higher lows on the daily.

GEV

Reached record highs after the company boosted its 2025 financial targets, doubled its dividend, and positioned itself as a primary beneficiary of the AI-driven power demand surge. Has a pivot here, watching for an entry.

AMKR

Growth is fueled by record revenue in its communications and computing segments, specifically driven by advanced packaging solutions for AI applications and the iOS ecosystem. Pulled back to the 20ma and has put in a series of higher lows. Watching for an entry.

DXYZ

This closed-end fund has spiked due to intense retail interest and a high premium for its "private equity for all" model, offering rare public exposure to companies like SpaceX and OpenAI. With space stocks all catching a bid, this is another one that has made a big move off the lows on increased volume.

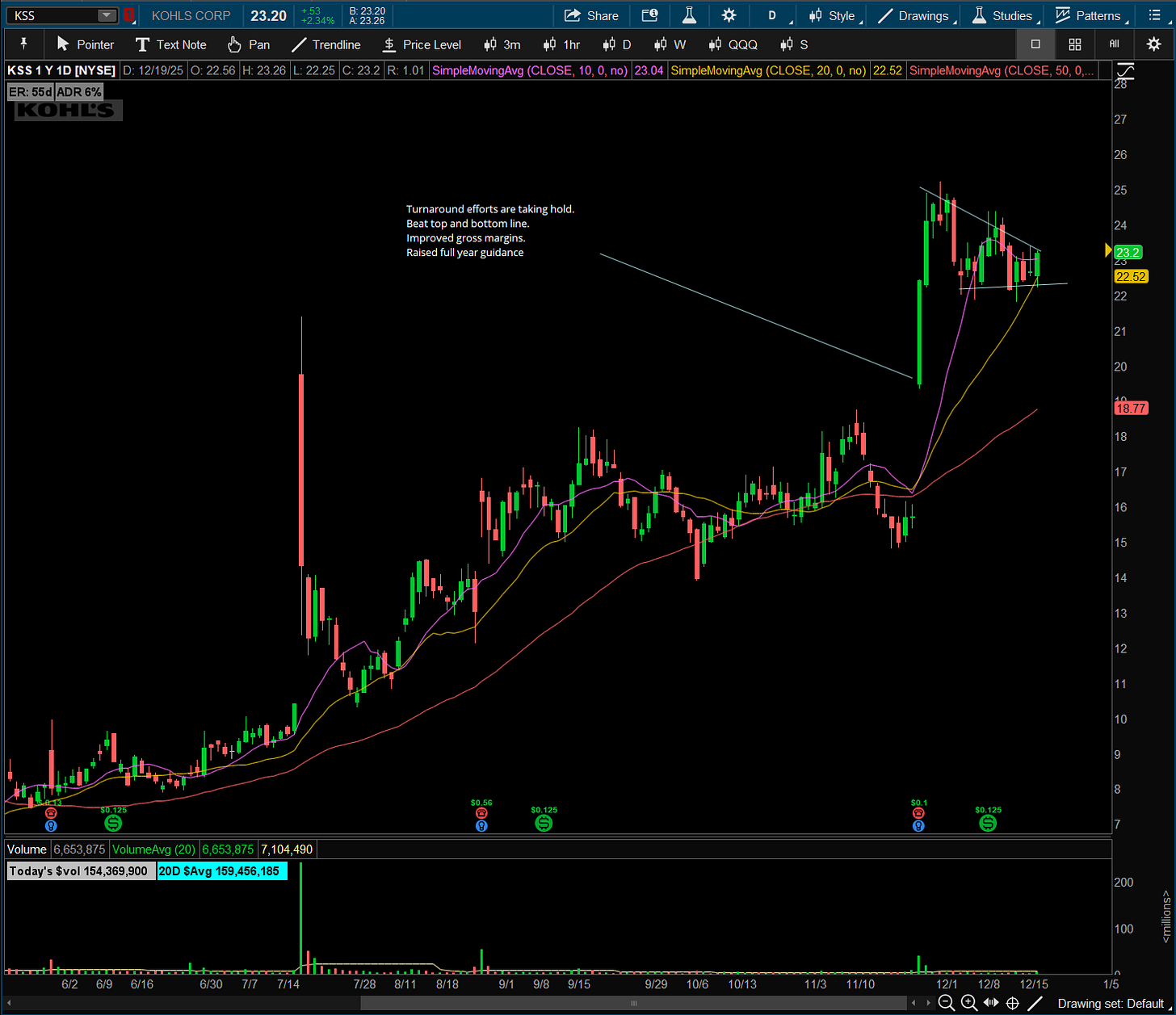

KSS

The stock rallied following a surprise Q3 profit beat, improved margin outlook, and the removal of the "interim" tag for its CEO, sparking momentum-buying and short-covering. A turnaround stock that has built a great looking flag with higher lows and the 20ma caught up. Watching for an entry.

WRBY

Recent gains were triggered by the announcement of a high-profile partnership with Google to develop and launch AI-powered smart glasses by 2026. Pulled back to a rising 10ma, watching for an entry over Friday’s high.