The Christmas to New Year holiday lull is now over.

Every year I get reminded how far I’ve come, and how much of my setbacks yr/yr are generally foundational like oversizing, entering positions with no set up, etc. We all make mistakes, the key is to make less and less of them, and stay present enough to where we can notice them quicker if they start to show up in our trading.

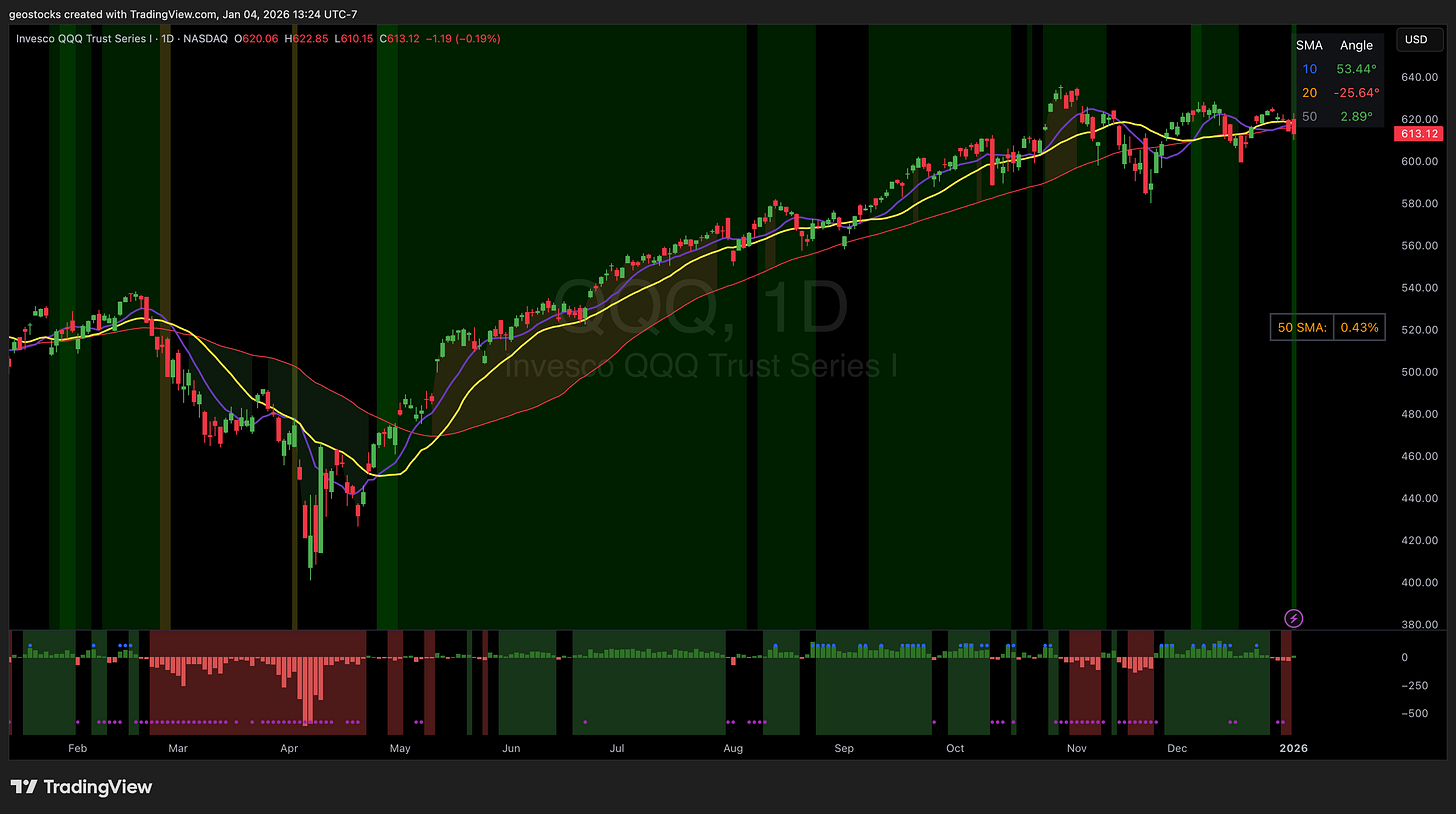

QQQ

Got back over the 50ma on Friday with tons of stocks having bullish responses, some even broke out. The 10 just crossed over the 20, the 10ma angle is sloping up, and the 20 is slightly down. As long as we continue to push out from here, should start to see the 20ma start to turn up as well.

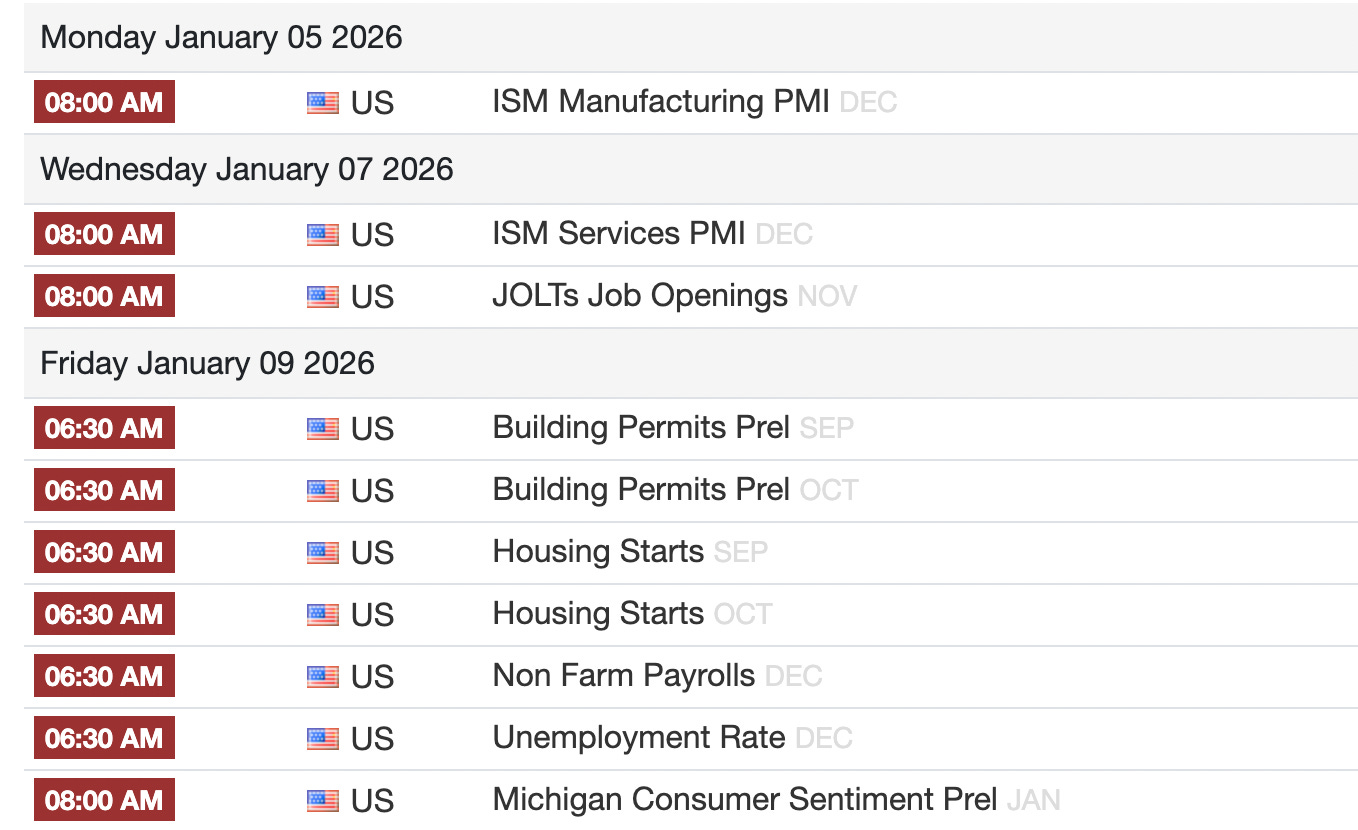

This weeks economic calendar

Stocks

I’ll start with stocks showing significant RS with fundamental drivers, and may be worth to put on watch for the next few weeks. At the end I point out the stocks that I have some alerts set in that may be looking for an entry.

SNDK (SanDisk): Riding a massive post-spinoff rally as its BiCS8 NAND technology becomes the go-to for AI data centers needing extreme storage speed.

ONDS (Ondas): Winning huge government and border security contracts that have ballooned their revenue targets to over $110M for 2026.

SIDU (Sidus Space): Surging on the back of a major $151M Missile Defense Agency contract and intense retail interest in “New Space” players.

TE (T1 Energy): Benefiting from a 25% jump in solar shipments as the U.S. pushes for domestic energy manufacturing to power new data hubs.

LUNR (Intuitive Machines): Cementing its role as NASA’s primary lunar delivery partner with a growing backlog of moon-landing missions.

MU (Micron): Profiting from a “supercycle” in memory where supply can’t keep up with the HBM4 chips required for Nvidia’s next-gen AI hardware.

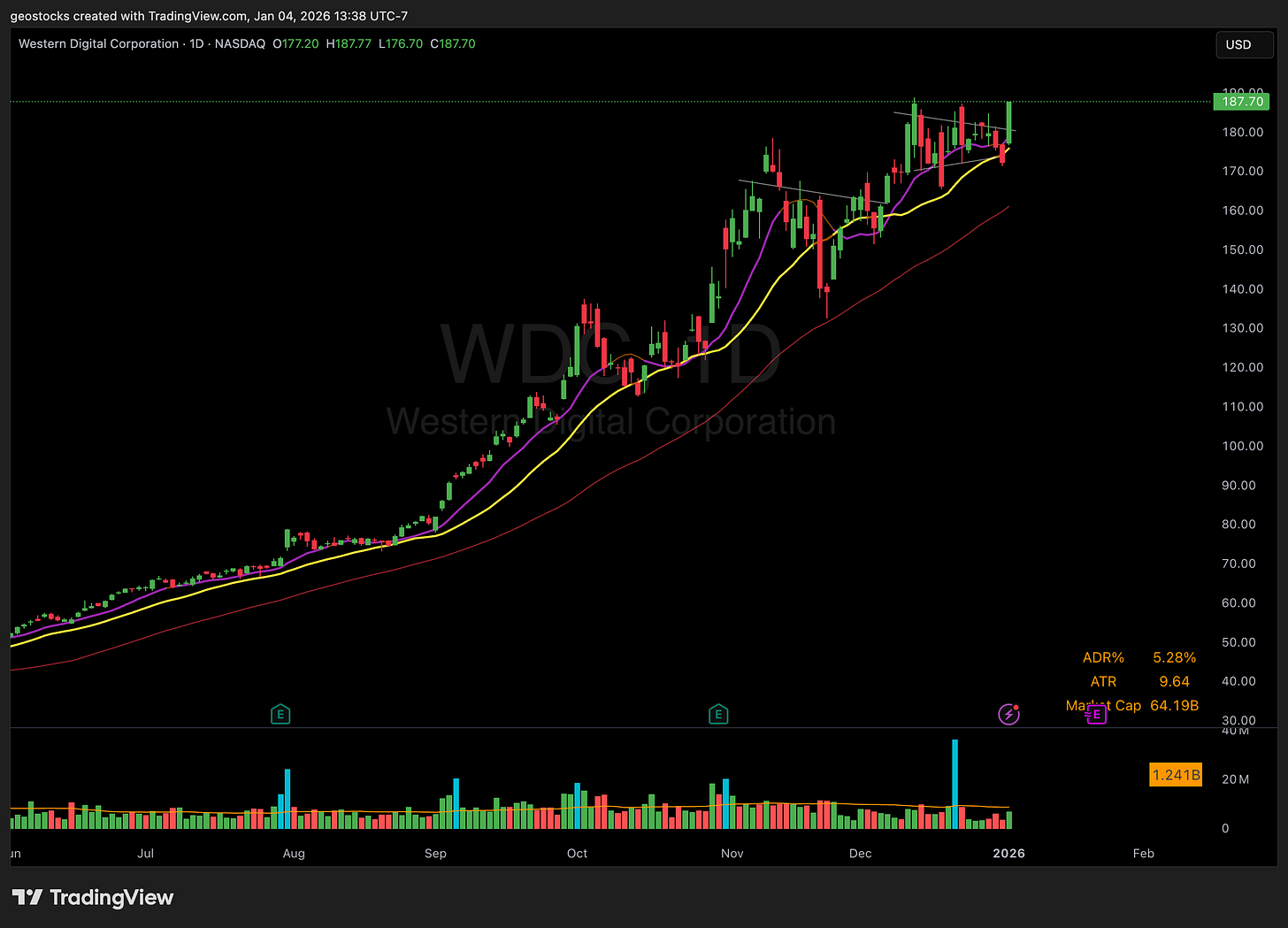

WDC (Western Digital): Seeing record margins as cloud giants buy up high-capacity drives to store the astronomical amounts of data AI is generating.

COHR (Coherent): Leading the market in the optical transceivers (the “plumbing” of the internet) needed to move AI data at 800G and 1.6T speeds.

GEV (GE Vernova): Capitalizing on the fact that power grids are hitting their limits; their gas turbines and grid tech are effectively “sold out” through 2028.

RKLB (Rocket Lab): Transitioning from a small-sat launcher to a major aerospace prime with a billion-dollar backlog and the Neutron rocket nearing launch.

PL (Planet Labs): Shifting from just taking photos of Earth to selling high-margin, AI-analyzed intelligence to government and defense agencies.

FLNC (Fluence): Capturing the urgent demand for massive battery systems needed to keep the power grid stable as AI and EVs drive electricity use to record highs.

STX (Seagate): Dominating the data center storage market as its HAMR technology (Heat-Assisted Magnetic Recording) allows cloud giants to pack 30TB+ onto a single drive, making it a critical, high-margin partner for the AI data explosion.

VIAV (Viavi Solutions): Thriving as the “referee” for high-speed internet; their testing gear is mandatory for companies building out 800G and 1.6T fiber networks to ensure AI clusters can actually talk to each other without lagging.

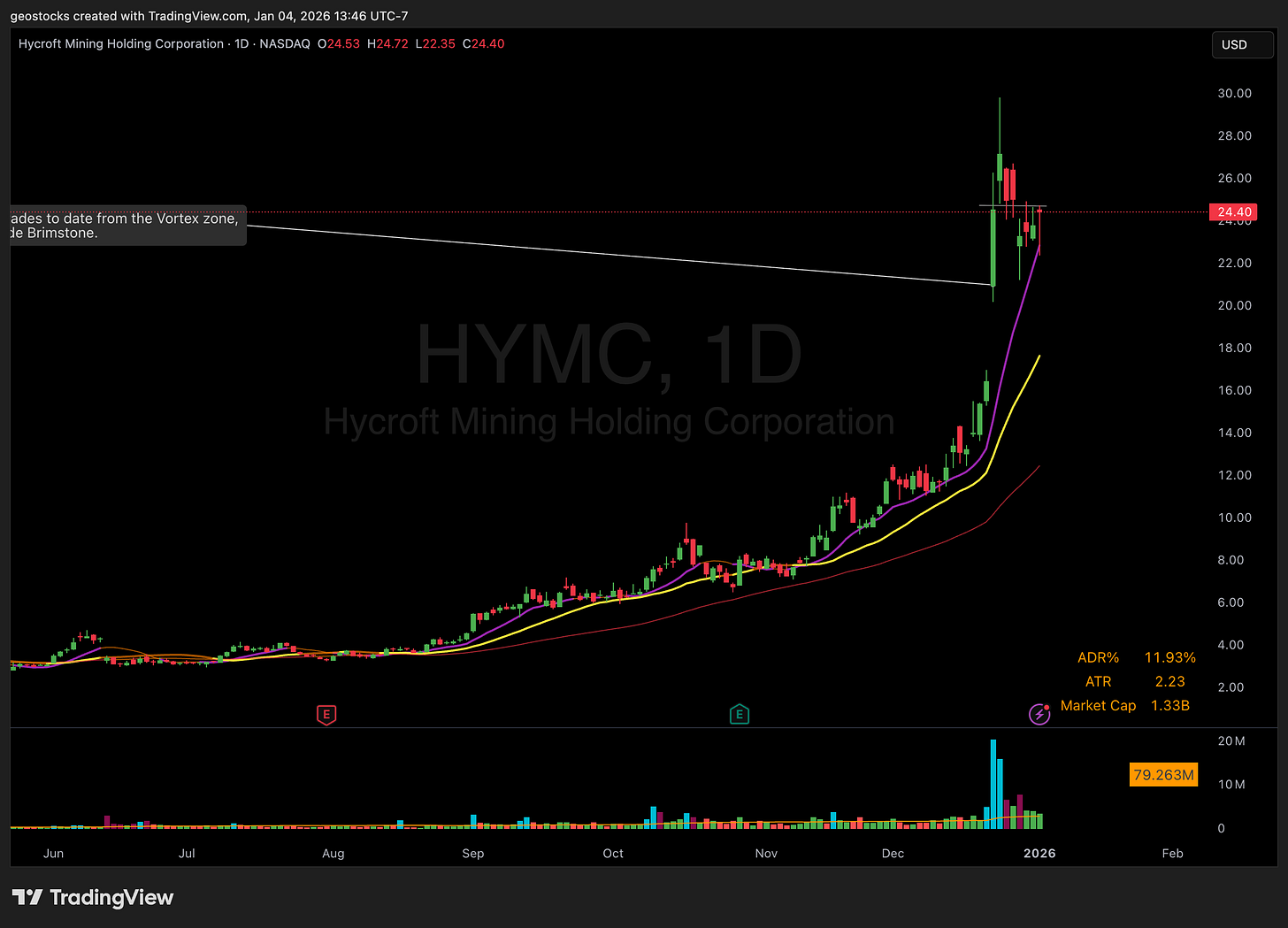

HYMC (Hycroft Mining): Exploding after hitting its highest silver grades ever at the Vortex zone in Nevada, which is fundamentally rewriting the company's valuation just as silver prices sit at record multi-year highs.

Good list, couple of names I hadn't noticed.

Thanks