Midway through January and it’s generally been a choppy environment in non-theme related stocks (e.g. growth stocks). Right now what is working is sticking with theme stocks, and watching catalysts every morning for potential changes of character.

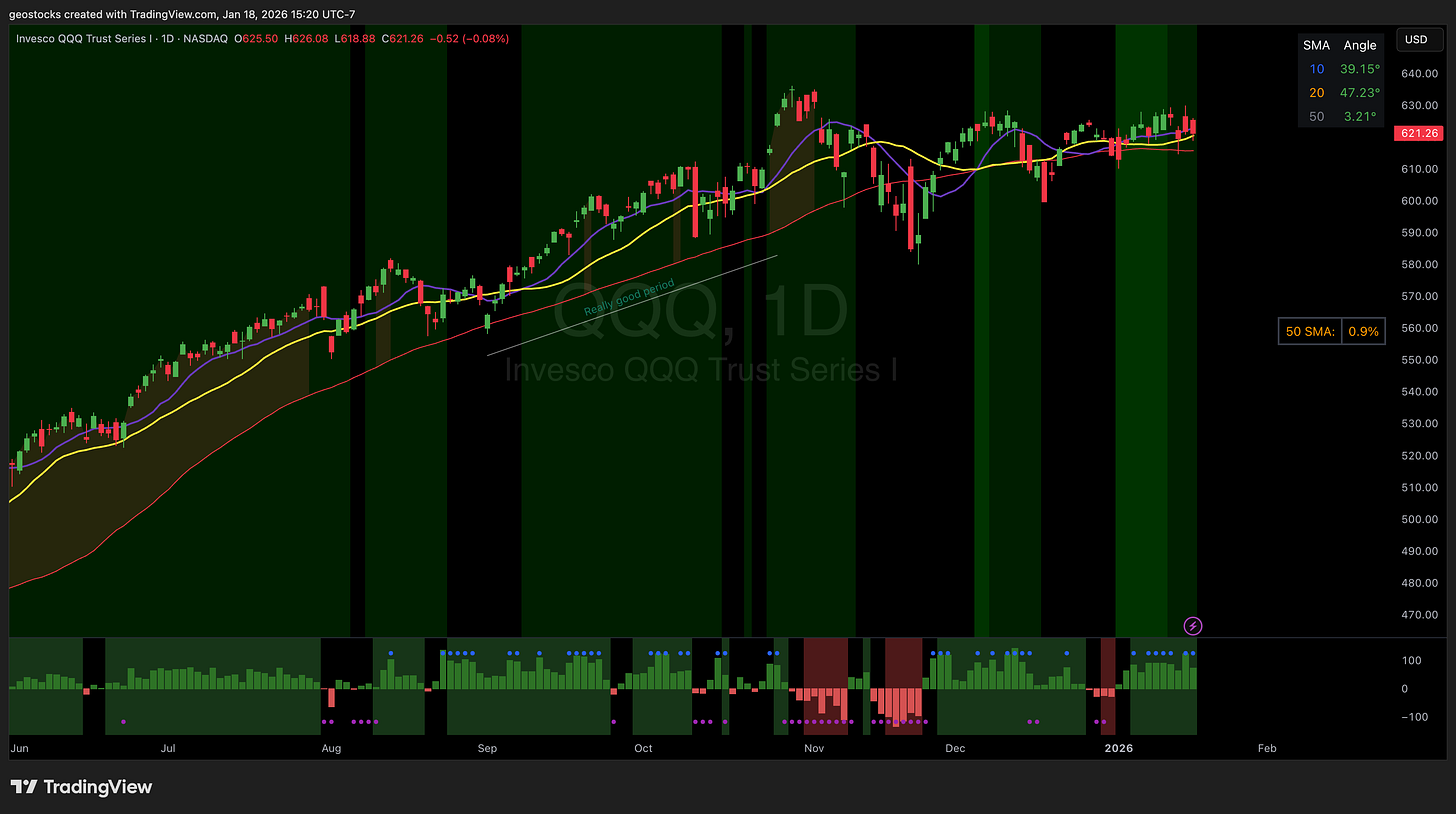

QQQ

Has been chopping back and forth all month. The moving averages are aligned for a move higher. However, we haven’t gotten much movement as the megacaps have been pinned. Breadth has been great. Regardless of what the index is doing, it is a traders job to listen to individual / groups of stocks.

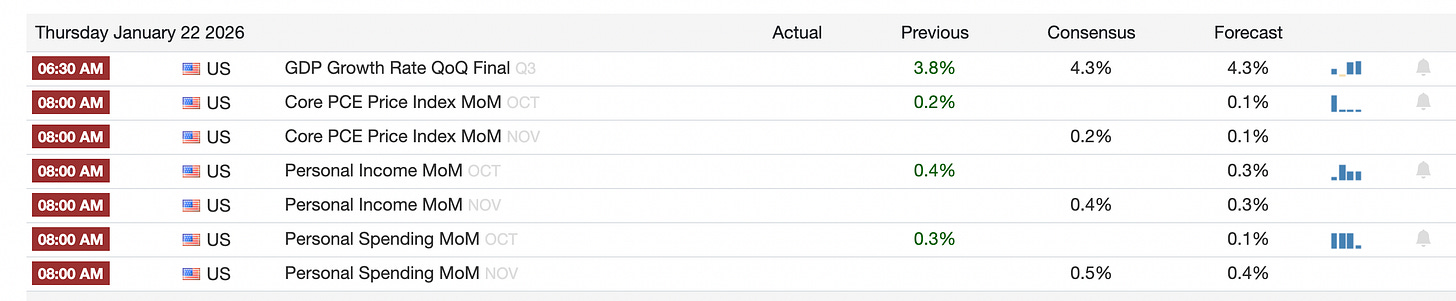

This weeks economic calendar

Stocks

There have been a lot of stocks making new highs as the index chops around. That’s where the focus should be. Staying away from previous leaders (e.g. HOOD, IREN, NBIS, etc.) and focusing on stocks that are trading on the upper right hand corner of my chart. Not saying IREN/NBIS/HOOD are trash.

SIDU space theme, probably the crappiest one of the bunch. They (shit names) do tend to make the biggest moves. Keeping it on watch.

ONDS pushed out of it’s base, and is consolidating. Has been part of the defense EO that Trump is pushing out. Waiting for a setup.

HUT probably the strongest btc miner. Had big news few weeks back. Didn’t like the setup on Friday. Will be watching to see if it gives me something clearer, or I’ll likely pass.

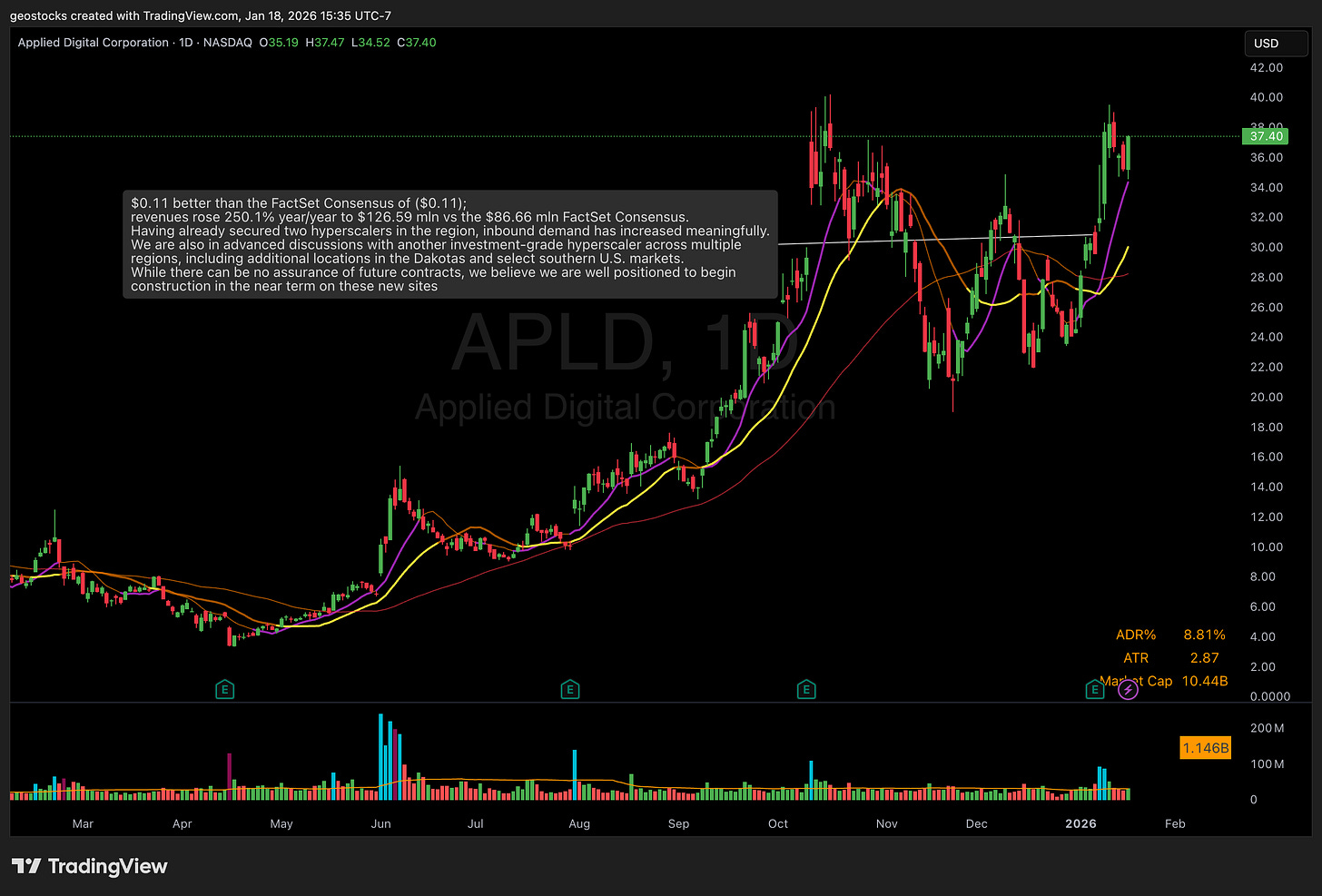

APLD similar thoughts to HUT above. Watching it for a clearer set up. 4-5 month base.

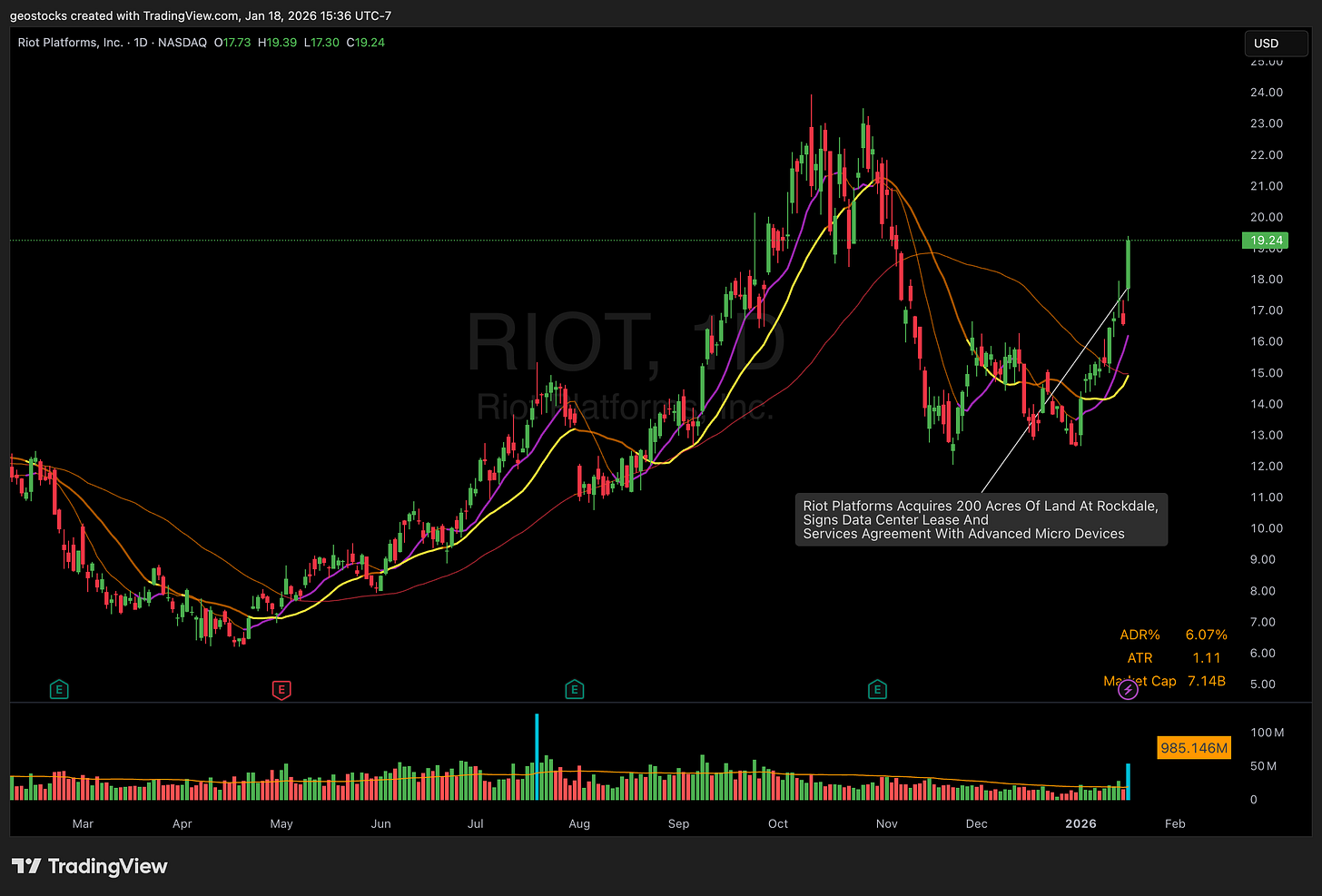

RIOT newer btc miner that had news with AMD on Friday. Will be watching it in the next few weeks for a clear set up of an MA.

—

Outside of those stocks, news-based episodic pivot trades are on watch.