Weekly Review 12.16 - 12.20

What a wild week this was. The lengthy and painful post FOMC dump after rates were reduced was short of incredible I’d say. This week was where some either got out with a scratch mark, or a deep scar if too exposed to market volatility. As time goes on, we will see what comes out of the distribution that is currently unfolding.

Market overall: The Nasdaq ended up closing just about under the 21ema as we started seeing downside pressure and distribution a day before FOMC. The post FOMC action was confirmation and really unwinded a lot of laggards, while some leaders are trying to hold their gains. Friday came around and gave a relief rally, which followed an end of day pull in certain stocks.

Open positions coming into this week:

ASAN 0.00%↑ - was long from the last weeks post earnings flag break. Took gains on the way up and cut the rest at break even once it came down to my cost.

NBIS 0.00%↑ - broke out from a small IPO base on earnings and Citron’s long report. I waited for it to pullback to the 10ma and got long over previous days highs. Booked some gains on day 1, then cut the rest at break even as it was pulling in harder than expected. Still one of my favorite stories that I’m following.

BITX 0.00%↑ - have been trading BTC via BITX as it gives me a bit more leverage. Was using BTC’s 100k as a line in the sand on my entry. Took gains on the way up, and got stopped break even on the rest of my shares after the FOMC rate cut announcement.

MSTX 0.00%↑ - got long once it reclaimed $400 and sold on the way up. Once it started to fade back down, I decided to cut my shares for a gain. Wasn’t going to let myself get bagged and was happy with my gain.

12/16

CONL 0.00%↑ - The idea here was that it was coming out of it’s range, and BTC was over 100k. Quickly got stopped out.

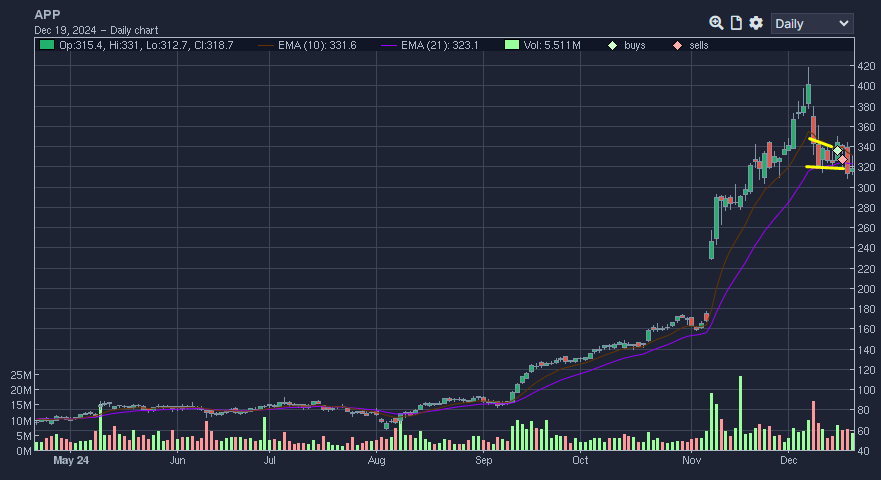

APP 0.00%↑ - a true market leader that has had a monster run and pulled back to the 21ema and no longer extended. Got long on the break of it’s range and got stopped out the next day.

MSTR 0.00%↑ - got long on the day of the range break and got stopped out the same day. This chart is different because tradervue’s chart is wonky due to the split.

12/17

MITK 0.00%↑ - got long based off a great earnings report and got stopped out shortly after.

12/18

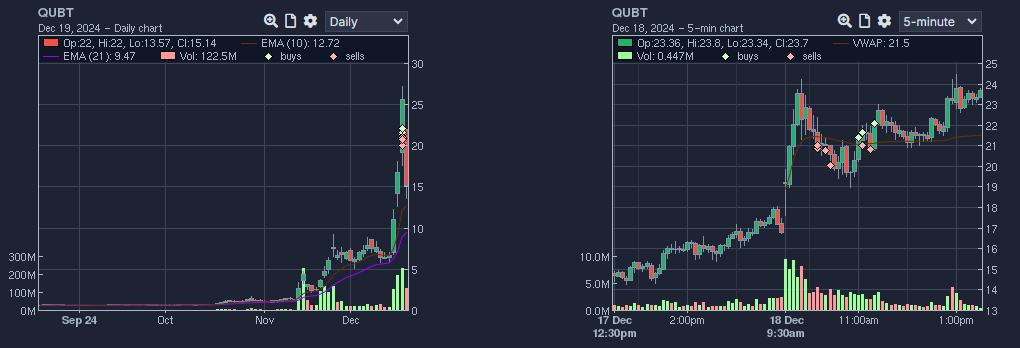

QUBT 0.00%↑ - this was the FOMC day and coming into the day I did say to my group of friends that I was going to ‘take it easy’ lol. Mind you I have been following the quantum trade and wanted to short it if the idea presented itself. I decided to risk this months profits on a big trade and it didn’t work out as I wanted it to. The volume was so high in the first few minutes of the session, I decided to get short under vwap and got too big way too fast because I was under the impression it wasn’t going to come back after it went under.

JOBY 0.00%↑ - was tracking ACHR and JOBY as they were attempting to break out. Got long and it started to reverse during FOMC so I cut it for a small gain.

12/19

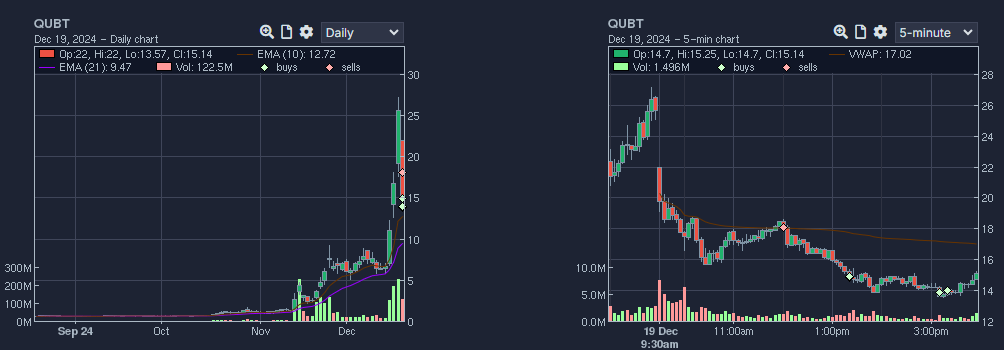

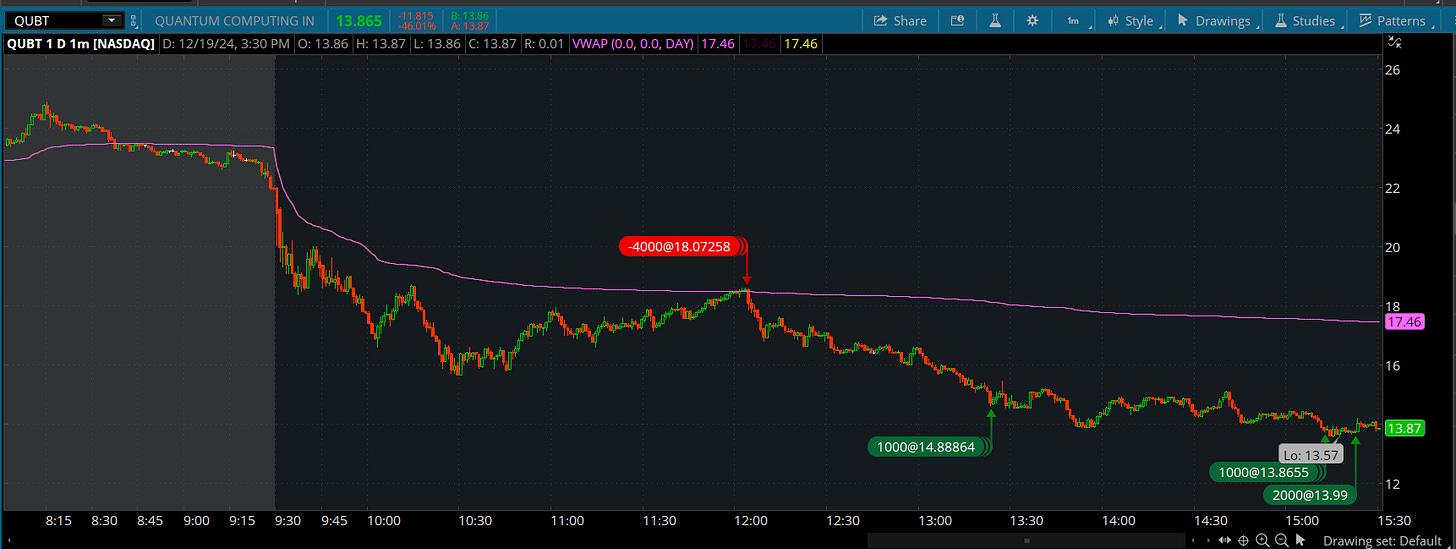

QUBT 0.00%↑ - gapping down today and is a more difficult short for that reason. I didn’t touch it all morning, until it slowly made it way to vwap. I wanted to be very precise on my entry as there was a lot of confluence at $18 (it marked the high of 12/17, roughly the low of 12/18, and most importantly todays vwap). Once it kissed vwap it very aggressively yanked down and that’s where I entered. My first target was under LOD if it was aggressive enough. Once it couldn’t get under the last lower low of $14, I covered the rest of my shares. I made half of what was lost on yesterday’s short, but happy to keep a level head through the trade and move on.

Here’s a better look at the execution.

12/20

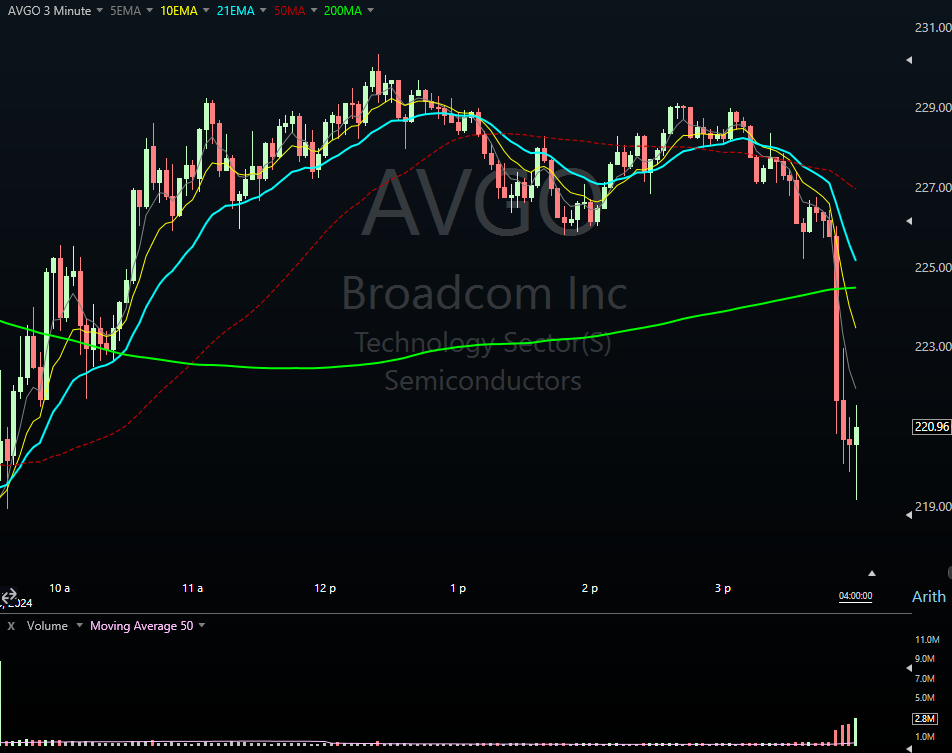

AVGO 0.00%↑ - coming into today, I wasn’t planning on executing any trades given the environment we were in. As the PCE data came in lighter than expected, we got a plethora of strong stocks act like nothing ever happened this past week, and the market also got a big rally. So I thought to myself, if this is a bottom, and we rally from here, I need to be in something.

Needless to say, AVGO was doing great all day untill it closed weak and stopped me out Lol. Fully cash now.

intraday chart for fun

Thanks for sharing ideas and trades.