Weekly Review 12.23 - 12.27

Volatile week to say the least. After FOMC dump, the index came back to test the 50ma, which seemed like a great buy spot considering all the stocks that were set up. Today’s session completely reversed those entries, and if managing risk, probably got stopped out of those positions for losses, flat, or small gain.

On the other side of the coin, we definitely have a proper pivot now to see if we can reclaim or if we continue lower, which will make this is a lower high in the index.

Once things start trending down, my edge does decrease as I need the markets wind at my back to make significant progress in the market.

No open positions to review coming into this week

12/23

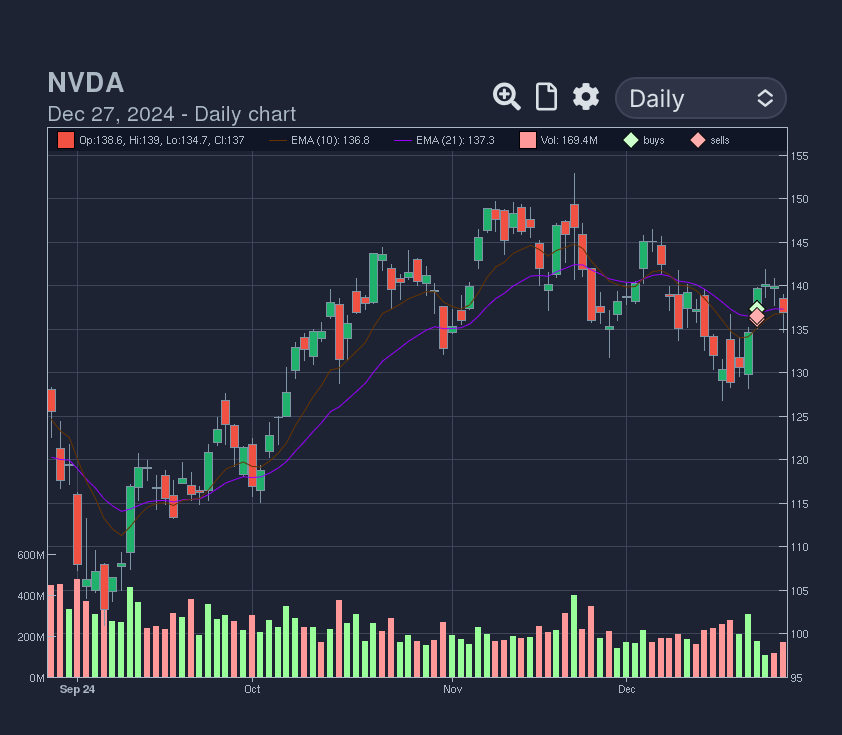

NVDA 0.00%↑ - entered at the the break of the daily range in the morning and got stopped at the lows. Now it has a greatly defined pivot to get long over 142s.

CRDO 0.00%↑ - post earnings pullback give the 21ema, got stopped out for small loss. Still watching it if it continues to build a range.

RUM 0.00%↑ - catalyst, rvol, neglected chart. Entered long on d1, got stopped out of some shares, and rebought them back. Have sold into strength and carrying over 1/3 of my position into next week.

12/24

SERV 0.00%↑ - bought it was it was breaking a range and got quickly stopped out. Did re-enter next days session.

RDDT 0.00%↑ - one of the leaders that I’ve been trying to get back into. Was able to get it on tight risk, it made a good move, but not enough to sell my first piece. Ended up getting stopped out on it on Friday.

HOOD 0.00%↑ - bought it as it was coming off the 21ema on a tight inside day. Booked it for a small gain on Friday.

OKLO 0.00%↑ - had news last week, bought it this week as it was breaking a range around 22. Sold some into strength and got stopped on the rest at b/e.

Only position I’m carrying over into next week is RUM 0.00%↑

Looking forward to next week and year, and hopefully we get some more setups!