Weekly Review 6.23 - 6.27

A look into my trading on a weekly basis with thoughts and executions.

This week was tricky. I ended up in the green but at the end of the day, since we have been so extended in the index, new positions were very choppy with no follow through. That is a culmination of this entire run up in the index, and now with the market being at ATH, there is a lack of great set ups. Leaders are extended, and seems that traders (me included) have started to search for sub par stocks to get involved in. Random trades lead to random results - and that randomness found its way into my trading a bit.

Here’s the QQQ for reference.

Trading is more than just finding a flag or a chart that “looks good.” Trading is about finding the stocks with the highest probability that it will push away from your average as quick as possible leaving you with no question that the stock rewarded you for analyzing it well.

This is why catalysts are very important in stocks. You need that fuel for a stock to go higher. I really don’t care about a technical set up out there that “looks good”. The best trades ALWAYS have a catalyst behind it. So instead of looking for random flags, and put them on my watchlist, I’m going to be making sure each of these stocks has a catalyst associated with them. That’s where the imbalance of supply and demand will come from.

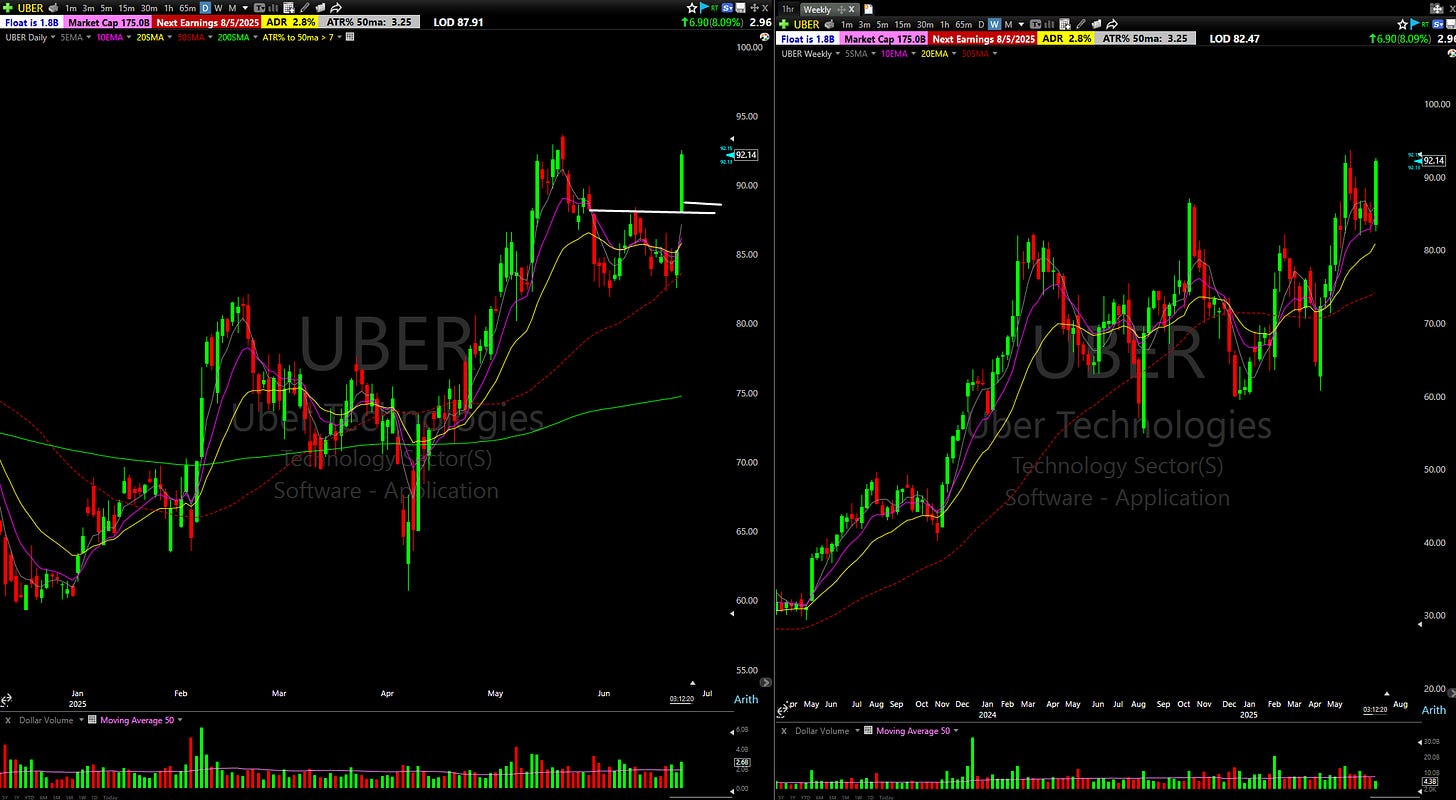

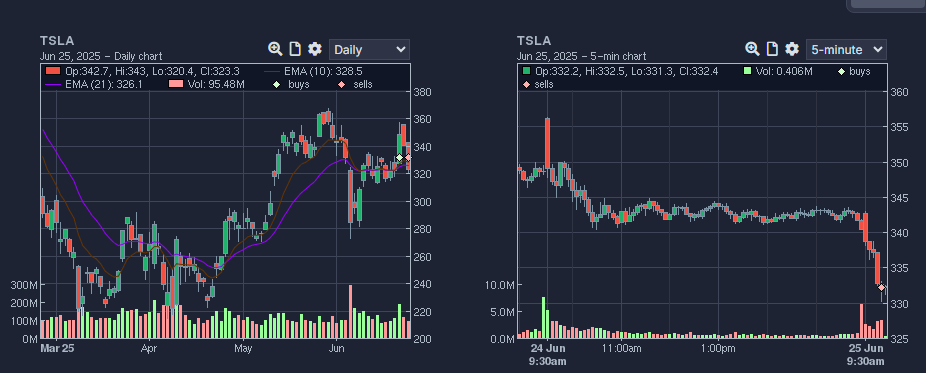

TICKER: TSLA 6/23

CATEGORY OF TRADE (INCLUDE CATALYST IF APPLICABLE): Low Cheat Flag Breakout, Robotaxi launch in Austin

CHART (DAILY AND WEEKLY):

EXECUTION: Bought it over pivot highs of 332-333. Stop LOD

THOUGHTS ON THE TRADE / LESSONS LEARNED: Chart was set up for a break out, and catalyst made it "easy" for price to get away from my average as soon as possible. Was able to get a full 25% position in TSLA as the stop was so tight.

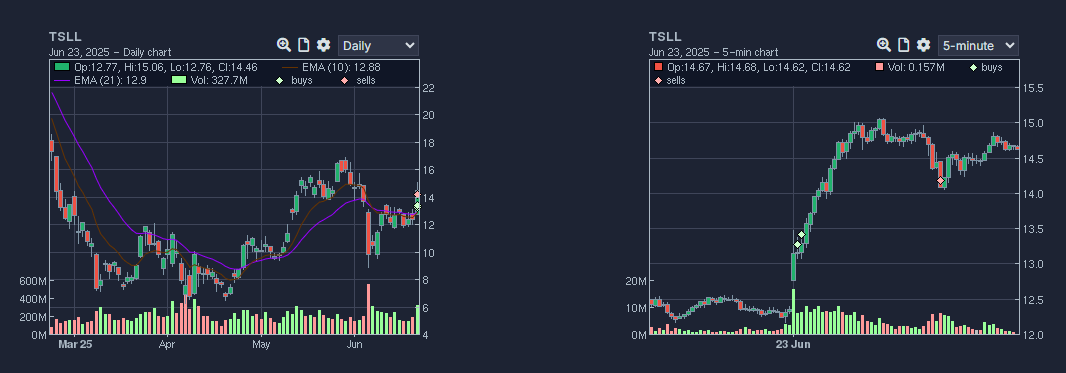

TICKER: TSLL 6/23

CATEGORY OF TRADE (INCLUDE CATALYST IF APPLICABLE): Similar to TSLA above

CHART (DAILY AND WEEKLY):

EXECUTION:Similar entries as TSLA, however sold out a bit early due to market pullback as insurance for my TSLA trade.

THOUGHTS ON THE TRADE / LESSONS LEARNED: Wasn't going to swing TSLL to begin with as already had TSLA. Sold it a bit premature given the market pullback and would rather just be in the main stock instead of dealing with decay.

---------------------------------------------------------------------------------------------------------

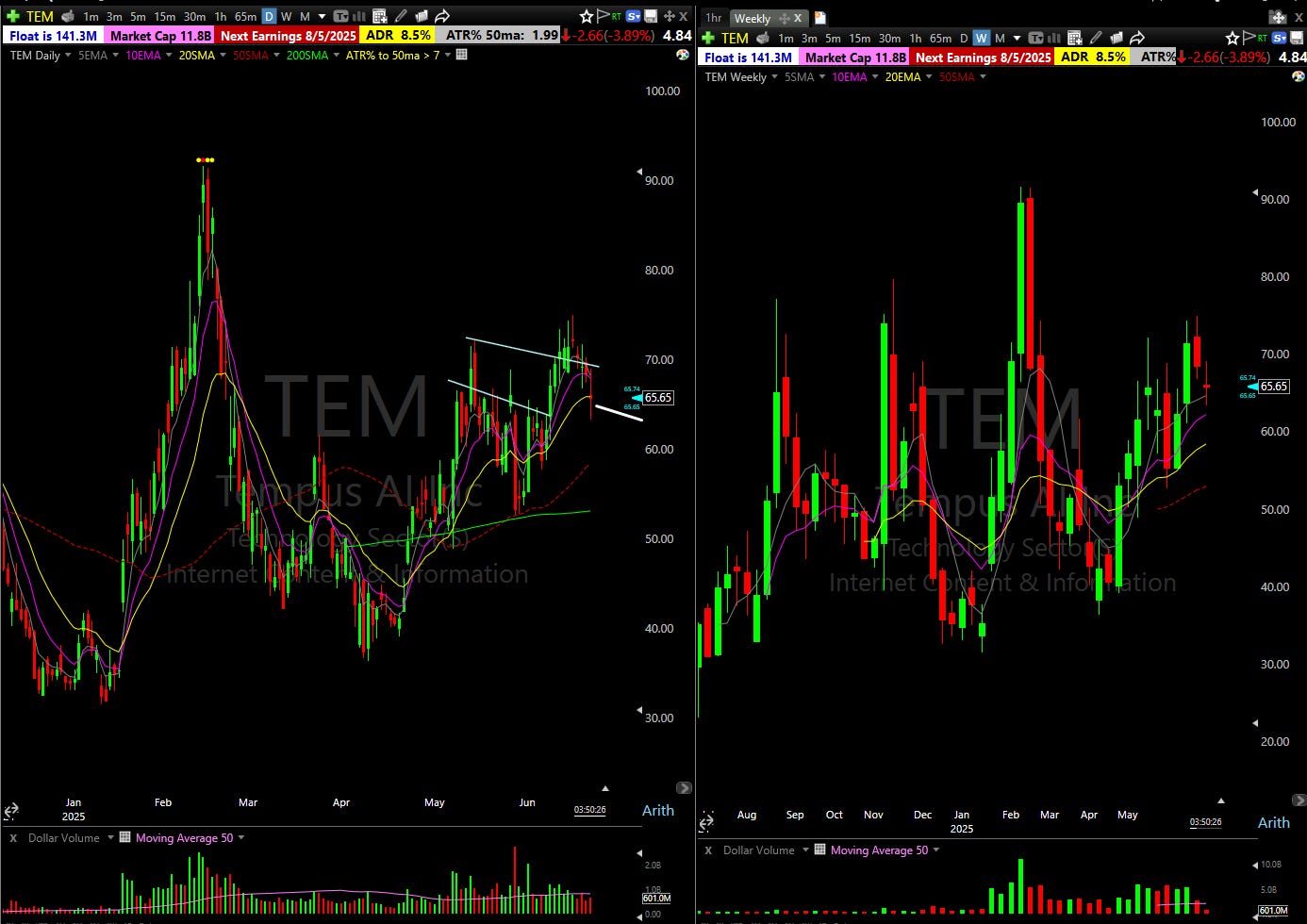

TICKER: TEM 6/28

CATEGORY OF TRADE (INCLUDE CATALYST IF APPLICABLE): Closing Trade

CHART (DAILY AND WEEKLY):

EXECUTION:

THOUGHTS ON THE TRADE / LESSONS LEARNED: Closed remainder of shares on gap down.

---------------------------------------------------------------------------------------------------------

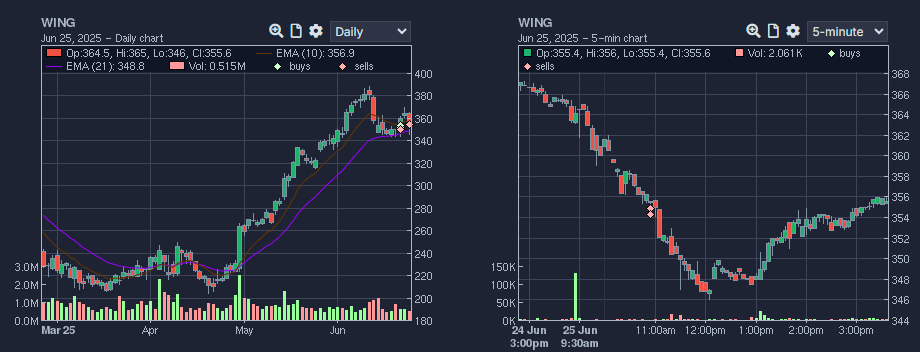

TICKER: WING 6/23

CATEGORY OF TRADE (INCLUDE CATALYST IF APPLICABLE): Post earnings MAPB Consolidation Breakout

CHART (DAILY AND WEEKLY):

EXECUTION:

THOUGHTS ON THE TRADE / LESSONS LEARNED: Bought WING on the initial push over the range of 352.5's with a stop at LOD. Once the market started to roll over I decided to cut the trade for a small loss, and decided to buy it back as the market started to gain strength. Closed strong on the day.

TICKER: NBIS 6/24

CATEGORY OF TRADE (INCLUDE CATALYST IF APPLICABLE): Flag Breakout

CHART (DAILY AND WEEKLY):

EXECUTION:Chased it a bit over $50 on small size, then looked to add on a higher high.

THOUGHTS ON THE TRADE / LESSONS LEARNED: I like the pick up in volume, and I also like how it shook some ppl out today intraday (not shown in tradervue ^^). Will be holding overnight as have a cushion.

---------------------------------------------------------------------------------------------------------

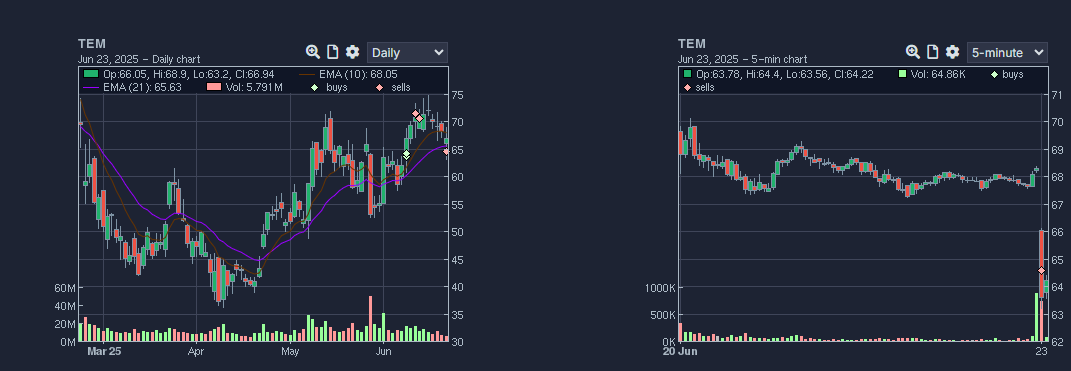

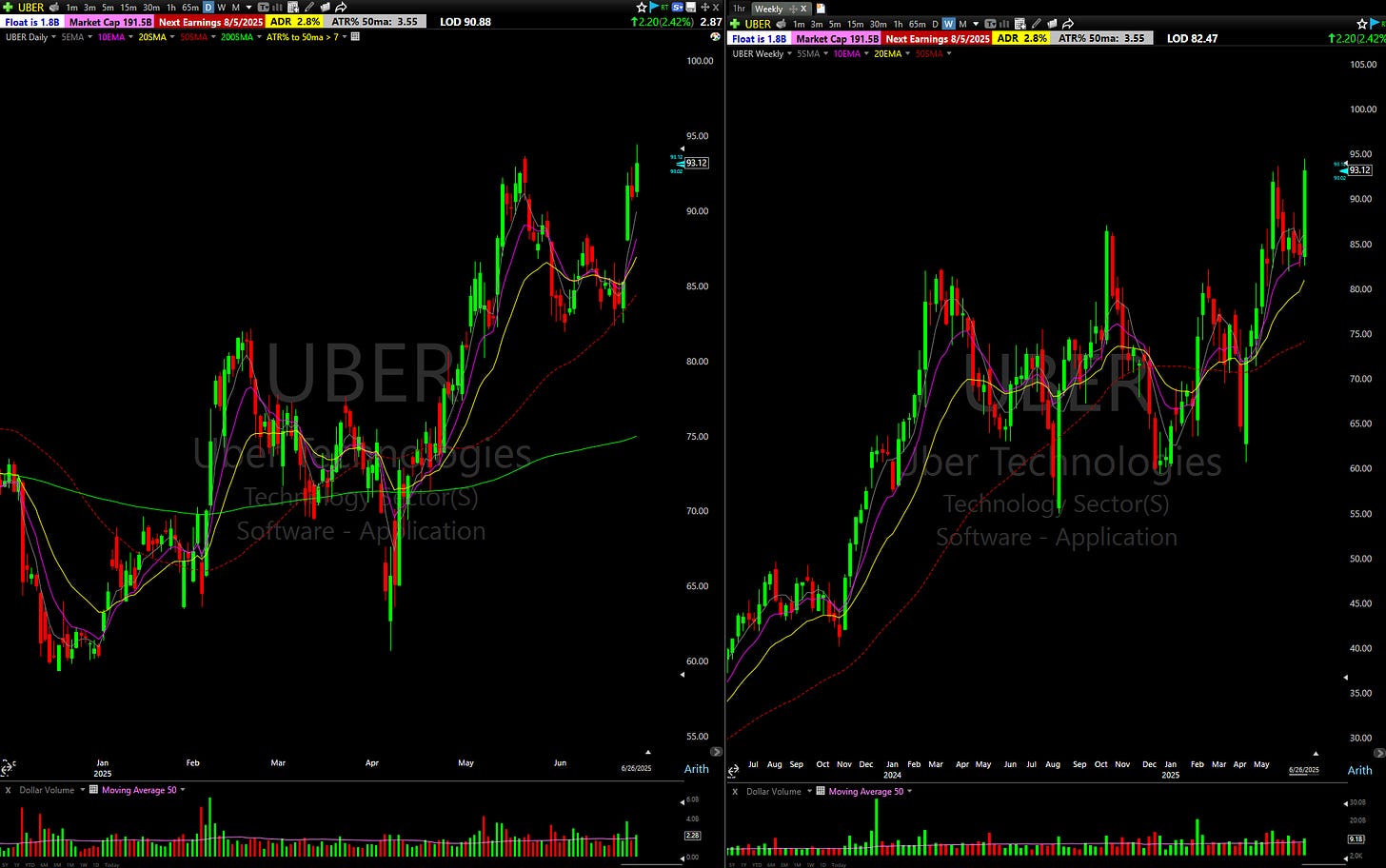

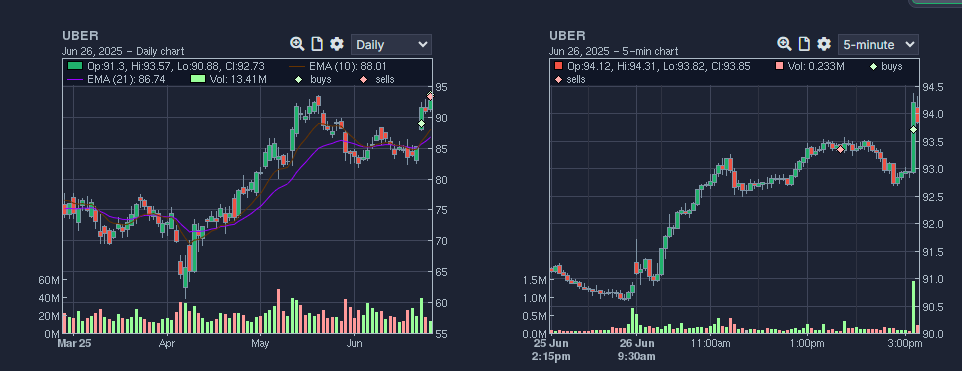

TICKER: UBER 6/24

CATEGORY OF TRADE (INCLUDE CATALYST IF APPLICABLE): Low Base Breakout, Waymo news being rolled out in Atlanta

CHART (DAILY AND WEEKLY):

EXECUTION: Bought the premarket high breakout. Stop LOD

THOUGHTS ON THE TRADE / LESSONS LEARNED: Chart, catalyst, and entry tactic were all valid. I'd say this is as close to 5 star it can get.

---------------------------------------------------------------------------------------------------------

TICKER: AVGO 6/24

CATEGORY OF TRADE (INCLUDE CATALYST IF APPLICABLE): Got upgraded

CHART (DAILY AND WEEKLY):

EXECUTION: Let the market settle and after AVGO pulled into vwap and held, I entered a position. Didn't do much by the close so closed the trade out for a small loss.

THOUGHTS ON THE TRADE / LESSONS LEARNED: OK looking trade, I think overnight gap messed up the entry given how choppy by nature the stock is. Looked a lot better yesterday for an entry than today.

TICKER: ODD 6/24

CATEGORY OF TRADE (INCLUDE CATALYST IF APPLICABLE): Low Base Breakout

CHART (DAILY AND WEEKLY):

EXECUTION:

THOUGHTS ON THE TRADE / LESSONS LEARNED: Let the market settle given the gap, once ODD went through the $75 offering high I put a position on. Decided to cut the trade given no follow through, also stock trades very thin.

TICKER: NBIS 6/25

CATEGORY OF TRADE (INCLUDE CATALYST IF APPLICABLE): Closing Position

CHART (DAILY AND WEEKLY):

EXECUTION:

THOUGHTS ON THE TRADE / LESSONS LEARNED: Round trip the entire gap up. Closed it for a loss. Nothing I can really do but let it play out.

---------------------------------------------------------------------------------------------------------

TICKER: WING 6/25

CATEGORY OF TRADE (INCLUDE CATALYST IF APPLICABLE): Closing Position

CHART (DAILY AND WEEKLY):

EXECUTION:

THOUGHTS ON THE TRADE / LESSONS LEARNED: Flat trade, closing under the 10 so closed it out.

---------------------------------------------------------------------------------------------------------

TICKER: TSLA 6/25

CATEGORY OF TRADE (INCLUDE CATALYST IF APPLICABLE): Closing Trade

CHART (DAILY AND WEEKLY):

EXECUTION:

THOUGHTS ON THE TRADE / LESSONS LEARNED: Round tripped gains at a b/e stop. Did not lose money on it.

TICKER: AVGO 6/25

CATEGORY OF TRADE (INCLUDE CATALYST IF APPLICABLE): ATH breakout (Cup and handle), semi's relatively strong.

CHART (DAILY AND WEEKLY):

EXECUTION:

THOUGHTS ON THE TRADE / LESSONS LEARNED: Been wanting to get myself situated in AVGO, after the morning pullback I wanted till close to the end of the day to enter a position at $264. My thoughts on the trade is I'll be using yesterdays LOD as a stop, as if it it breaches that then the stock may have a bigger pullback. Stop is a 1.8% stop on a $260 stock. Just want to let it trade at this point given how choppy the stock is by nature.

TICKER: MSTR 6/26

CATEGORY OF TRADE (INCLUDE CATALYST IF APPLICABLE): Consolidation Breakout

CHART (DAILY AND WEEKLY):

EXECUTION:

THOUGHTS ON THE TRADE / LESSONS LEARNED: Still in a range, took loss and moved on. Lagging BTC at the moment. Normal loss

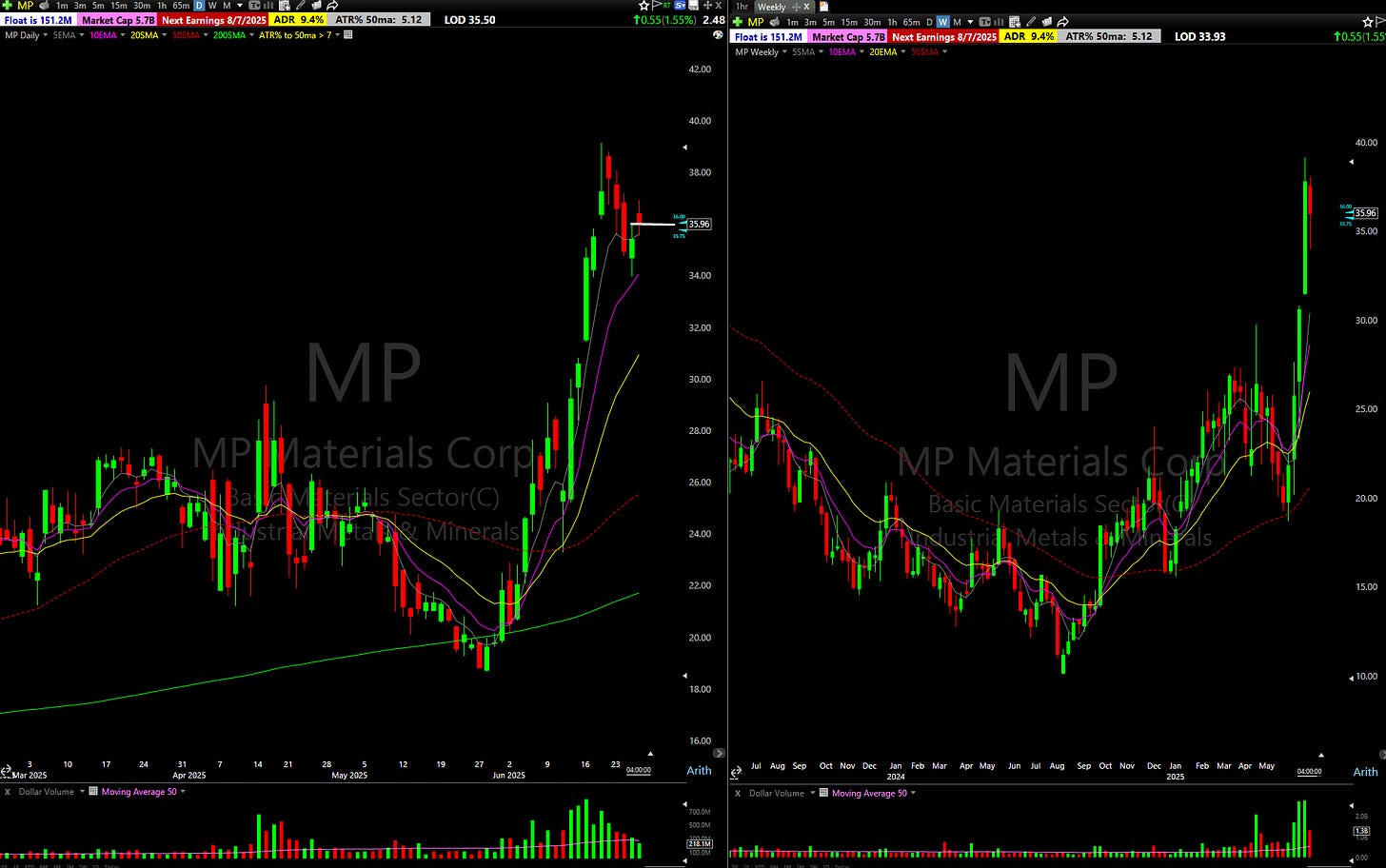

TICKER: MP 6/26

CATEGORY OF TRADE (INCLUDE CATALYST IF APPLICABLE): Higher low

CHART (DAILY AND WEEKLY):

EXECUTION:

THOUGHTS ON THE TRADE / LESSONS LEARNED: Given the gap up, I waited for it after the open to get involved, bought it through vwap and got stopped later in the day. Normal loss.

---------------------------------------------------------------------------------------------------------

TICKER: OSCR 6/26

CATEGORY OF TRADE (INCLUDE CATALYST IF APPLICABLE): Consolidation breakout

CHART (DAILY AND WEEKLY):

EXECUTION:

THOUGHTS ON THE TRADE / LESSONS LEARNED: Was a great push off the open above yesterdays high. Fizzled out during the day and just closed it for a small loss.

---------------------------------------------------------------------------------------------------------

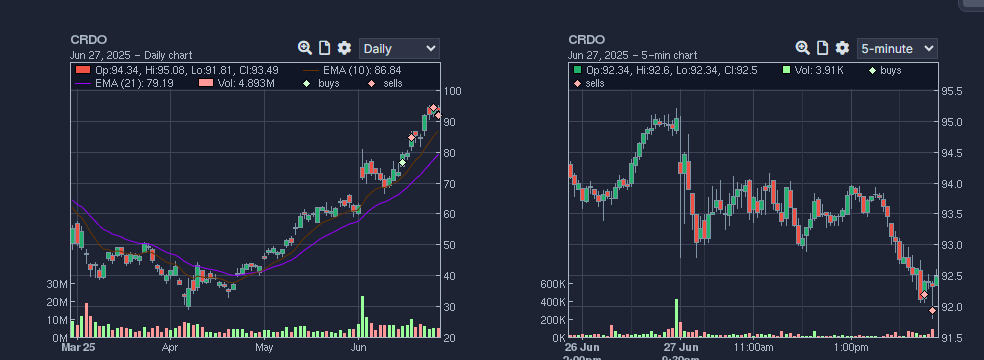

TICKER: CRDO 6/26

CATEGORY OF TRADE (INCLUDE CATALYST IF APPLICABLE): Selling partial

CHART (DAILY AND WEEKLY):

EXECUTION:

THOUGHTS ON THE TRADE / LESSONS LEARNED: Trimming some into strength. Have half size left on this position from $76.

---------------------------------------------------------------------------------------------------------

TICKER: UBER 6/24

CATEGORY OF TRADE (INCLUDE CATALYST IF APPLICABLE): Trimming position, and adding back

CHART (DAILY AND WEEKLY):

EXECUTION:

THOUGHTS ON THE TRADE / LESSONS LEARNED: Trimmed 1/3 at recent highs, once the news hit that they were going to work on their own robotaxi, I added back my shares at highs. Back to a full size in UBER.

TICKER: TNA 6/27

CATEGORY OF TRADE (INCLUDE CATALYST IF APPLICABLE): 200MA Breakout in IWM

CHART (DAILY AND WEEKLY):

EXECUTION:

THOUGHTS ON THE TRADE / LESSONS LEARNED: Took the orb and scratched it for a small loss.

---------------------------------------------------------------------------------------------------------

TICKER: APLD 6/27

CATEGORY OF TRADE (INCLUDE CATALYST IF APPLICABLE): MA PB Consolidation Break

CHART (DAILY AND WEEKLY):

EXECUTION:

THOUGHTS ON THE TRADE / LESSONS LEARNED: As APLD was pushing over yestrday's HOD, I put a position on and noticed that it wasn't pushing out. I decided to cut it for a small loss and moved on.

TICKER: MSTR 6/27

CATEGORY OF TRADE (INCLUDE CATALYST IF APPLICABLE): Consolidation Breakout

CHART (DAILY AND WEEKLY):

EXECUTION:

THOUGHTS ON THE TRADE / LESSONS LEARNED: Tried MSTR three times, and got chopped up for a small loss altogether. Left the stock alone after my last exit.

---------------------------------------------------------------------------------------------------------

TICKER: PLTR 6/27

CATEGORY OF TRADE (INCLUDE CATALYST IF APPLICABLE): Exiting position

CHART (DAILY AND WEEKLY):

EXECUTION:

THOUGHTS ON THE TRADE / LESSONS LEARNED: Exited PLTR trail once it made a lower low as the market was holding up. Glad I got out once it didn't feel right as it closed way lower. Exited the trade and gave back too much but glad with the result.

---------------------------------------------------------------------------------------------------------

TICKER: CRDO 6/27

CATEGORY OF TRADE (INCLUDE CATALYST IF APPLICABLE): Exiting position

CHART (DAILY AND WEEKLY):

EXECUTION:

THOUGHTS ON THE TRADE / LESSONS LEARNED: Exiting position on a great trade. One of my biggest wins this month. With the markets at highs, I thought it was a good idea to take my gains and call it a good trade.

---------------------------------------------------------------------------------------------------------

TICKER: AVGO 6/27

CATEGORY OF TRADE (INCLUDE CATALYST IF APPLICABLE): Closing Position

CHART (DAILY AND WEEKLY):

EXECUTION:

THOUGHTS ON THE TRADE / LESSONS LEARNED: With the market breaking down, I sold AVGO for a small win. Markets feel very vulnerable and would not want to make a good win turn into a loss.

If you’ve made it this far, thank you for reading.

For anyone new:

I post in-depth Stocks in Play reports twice a week. Subscribers receive nightly watchlists, while my daily reviews are shared for free.

Hope you find value in these updates!